As the holidays approach, most full-time workers say their regular paychecks aren’t enough to cover the costs of gifts, travel, and celebrations. In November, ResumeTemplates.com surveyed 1,000 full-time workers to learn how they’re managing the financial strain this season.

Highlights:

- 61% of full-time workers say it’s harder to afford holiday expenses this year

- 3 in 10 are struggling more due to the loss of government benefits

- 2 in 3 full-time workers will take on additional work to cover costs

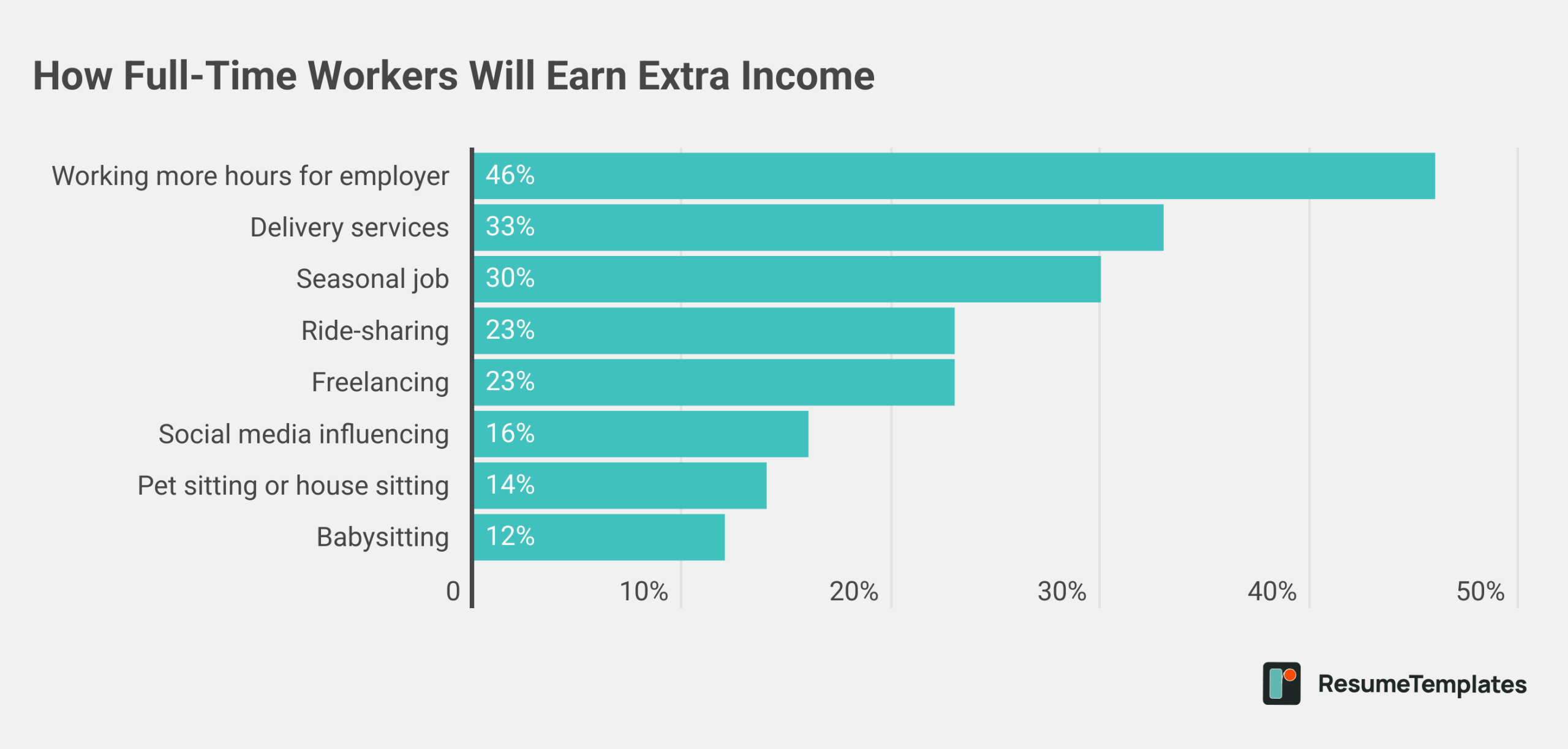

- The most common side jobs are extra hours, delivery, and seasonal retail

- Over one-third will spend less on gifts, decor, and travel this year

6 in 10 Full-Time Workers Report the Holidays Are Harder To Afford This Year

Compared to last year, 61% of full-time workers say it’s harder to afford holiday-related expenses. For about 30%, the loss of government benefits such as SNAP or insurance assistance is a contributing factor.

“It’s not unusual for people to feel financial pressure during the holidays, but this year the stress seems even higher,” says Julia Toothacre, Chief Career Strategist at ResumeTemplates.com. “The deeper issue is that full-time employment no longer guarantees financial stability. Wages aren’t keeping pace with costs, and many people are being forced to find extra income just to maintain a basic standard of living.”

2 in 3 Will Pick Up Extra Work To Cover Holiday Costs

More than a third (36%) of full-time workers say they’re already earning additional income to help pay for holiday-related costs, while 29% plan to do so. Only 34% say they don’t intend to take on extra work.

Among those seeking additional income, the most common approach is working more hours for their current employer (46%), followed by delivery services (33%), seasonal retail jobs (30%), ride-sharing (23%), and freelancing (23%). Smaller shares are turning to social media (16%), pet sitting (14%), and babysitting (12%) for additional income.

Of those already earning additional income, 37% say it was difficult to find opportunities to do so. Among those planning to earn extra income, nearly half (48%) say it has been or they anticipate it will be hard to find opportunities.

More than one-third of workers (39%) say taking on more work has or will likely hurt their productivity at their full-time job.

“Employees taking on extra work need to stay mindful of their energy and mental health,” says Toothacre. “Overworking can quickly lead to burnout, fatigue, and declining performance in both their main job and side work. It’s important to build in time to rest and recharge, even if that means scaling back productivity to a sustainable level. In some cases, doing ‘enough’ to meet expectations, rather than constantly overperforming, might be the healthiest choice. Balance looks different for everyone, but being realistic about your limits is what keeps you going long term.”

Many Will Spend Less Than Typical on the Holidays

When asked how their spending will change this year, 35% of full-time workers say they’ll spend less on gifts, 29% will spend less on decor, and 26% will spend less on travel. Additionally, 25% plan to reduce spending on food.

Methodology: This survey was conducted in November 2025 using the Pollfish platform. It includes responses from 1,000 full-time U.S. workers aged 18 and older. The sample was census-balanced for region and age.

Resume Templates offers HR approved resume templates to help you create a professional resume in minutes. Choose from several template options and even pre-populate a resume from your profile.