A good accounts receivable resume focuses on your relevant skills like data analysis or collections process improvement. Give examples of your success in accounts receivable or similar roles, and show your knowledge base by citing any training or certificate programs you’ve done. This guide provides expert tips to help you create a results-driven resume showing your best accounts receivable qualifications.

Key takeaways:

- Brainstorm details about your work history on a separate document or sheet of paper. Then, identify the most relevant ones to feature in your experience section – this helps you focus your resume so it positions you for the accounts receivable role.

- Use bullet points to display your achievements. Start each bullet point with a strong verb like “Created” or “Enhanced.”

- Spell out the results of your past work in accounts receivable. Describe how your efforts helped the wider organization achieve its goals.

Most Popular Accounts Receivable Resumes

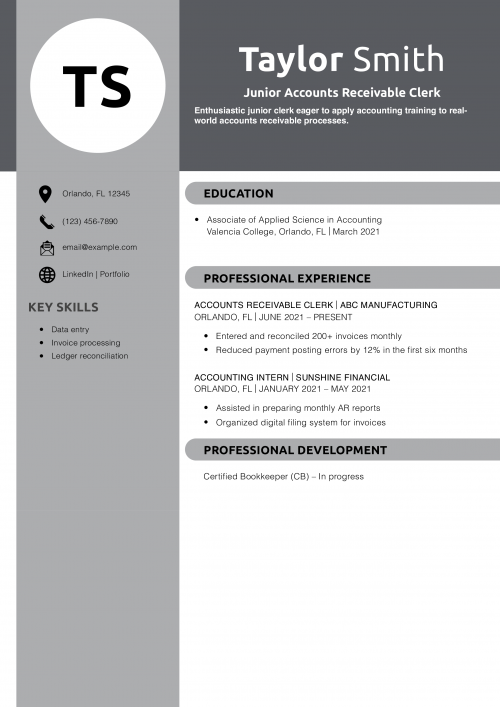

Accounts Receivable Clerk Resume Example

Why This Resume Is a Great Example

Taylor’s resume demonstrates both precision and efficiency in accounts receivable operations. The clearly defined bullet points quantify workload and outcomes, making achievements stand out. See how to list skills on a resume.

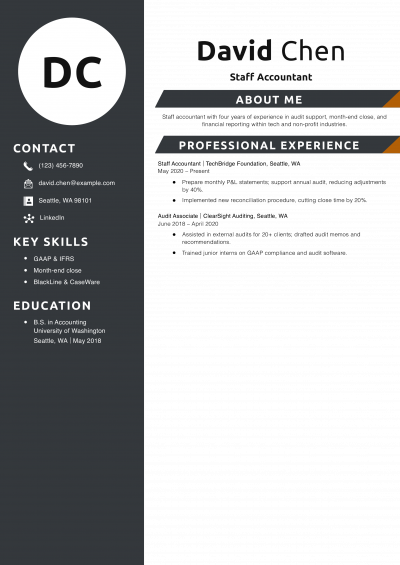

Accounts Receivable Specialist Resume Example

Why This Resume Is a Great Example

Alex’s resume emphasizes impact through concise, results-driven points. The measurable outcomes highlight performance, which recruiters want to see. For more ideas, check out resume action words.

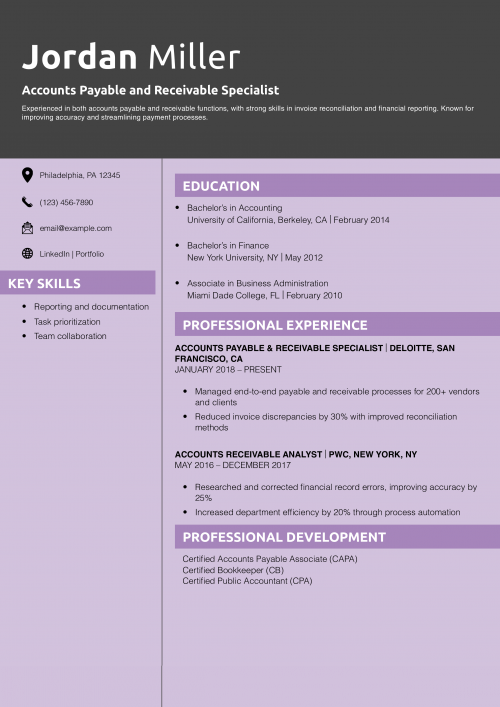

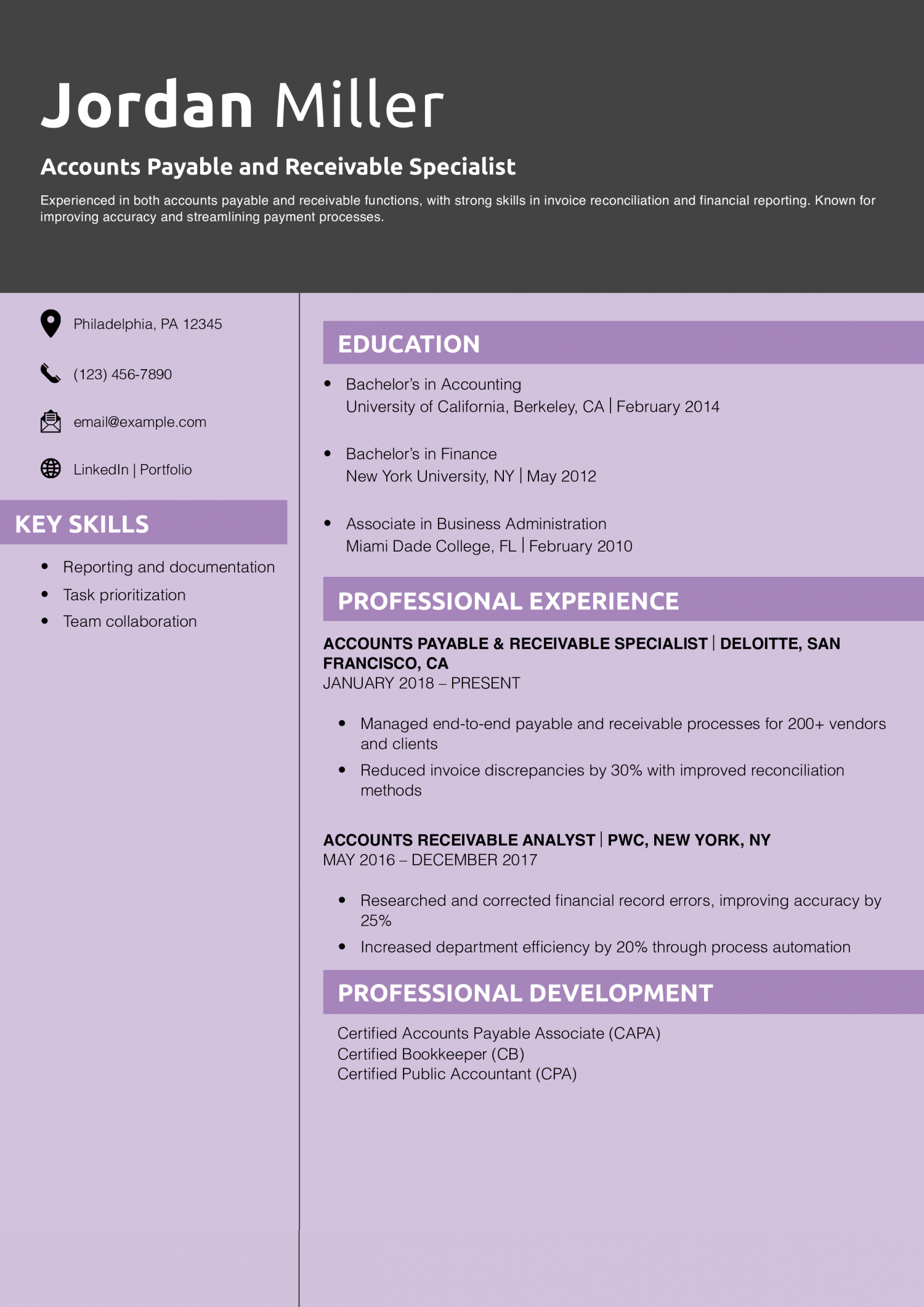

Accounts Payable and Receivable Specialist Resume Example

Why This Resume Is a Great Example

Jordan’s resume showcases versatility, managing two related but distinct financial functions with measurable improvements. Learn how to make a resume that shows your ability to handle multiple responsibilities.

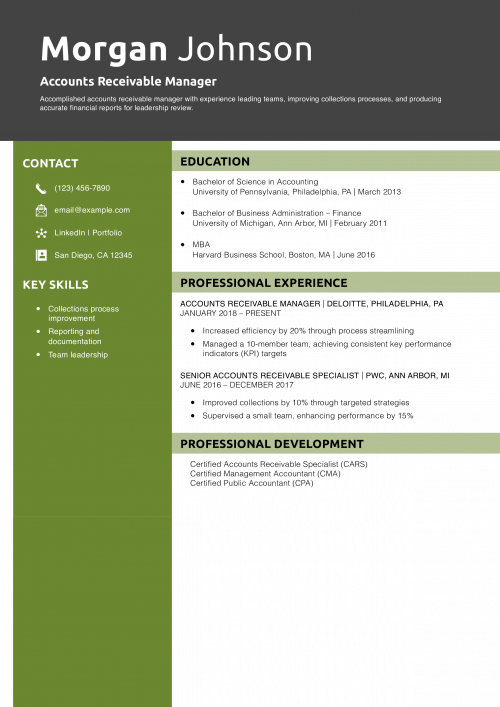

Accounts Receivable Manager Resume Example

Why This Resume Is a Great Example

Morgan’s resume emphasizes leadership and process improvement — two key qualities for management roles. To refine your own, see resume objective examples.

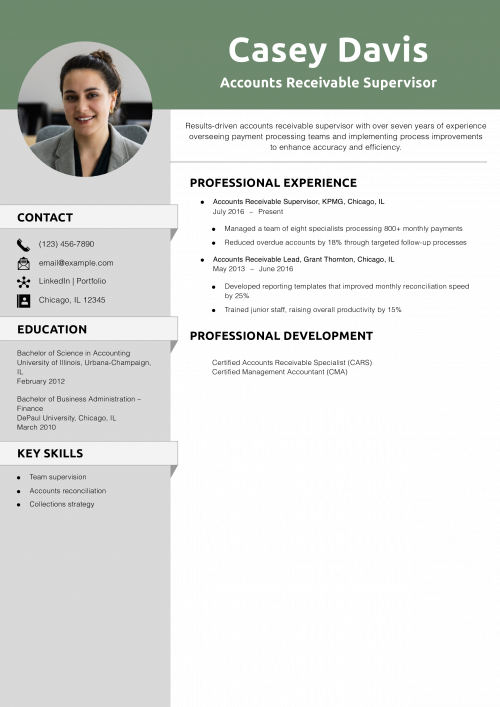

Accounts Receivable Supervisor Resume Example

Why This Resume Is a Great Example

Casey’s resume reflects leadership ability and the skill to improve team performance. To strengthen yours, check out best resume formats.

Accounts Receivable Analyst Resume Example

Why This Resume Is a Great Example

Jamie’s resume proves the ability to use data to improve collections accuracy and operational efficiency. Learn how to put your analytical skills front and center.

Accounts Receivable Collections Specialist Resume Example

Why This Resume Is a Great Example

Cameron’s resume balances firm collections results and positive client relationships. See tips on writing a job description.

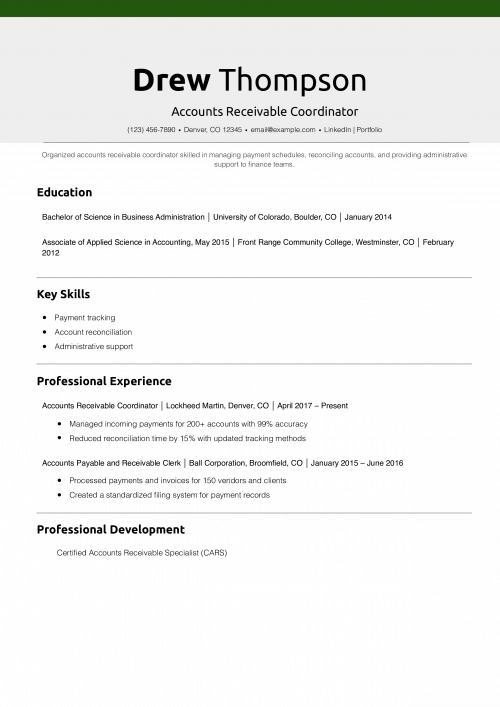

Accounts Receivable Coordinator Resume Example

Why This Resume Is a Great Example

Drew’s resume highlights process efficiency improvements and organizational skill. Read how to structure your experience section.

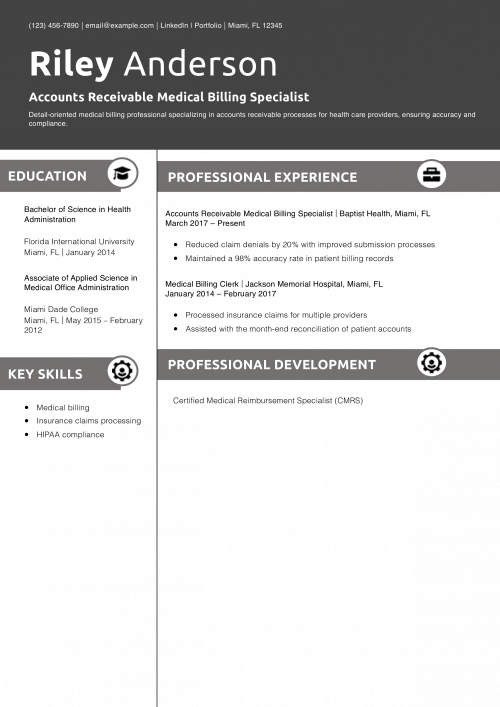

Accounts Receivable Medical Billing Specialist Resume Example

Why This Resume Is a Great Example

Riley’s resume demonstrates niche expertise in healthcare finance with compliance awareness. See more about tailoring resumes for specialized fields.

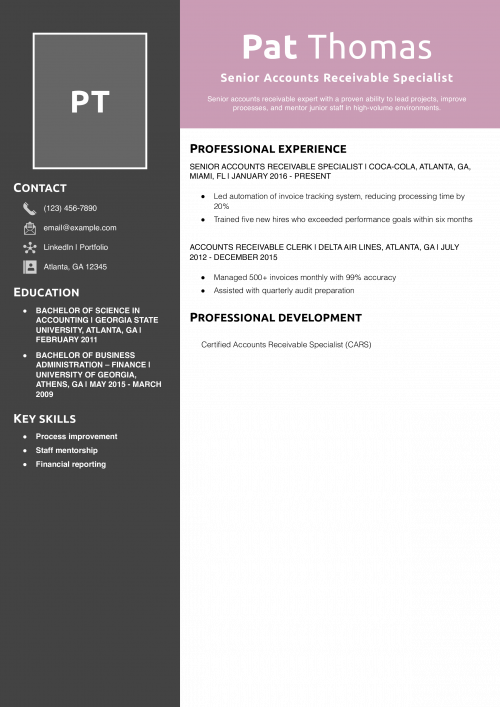

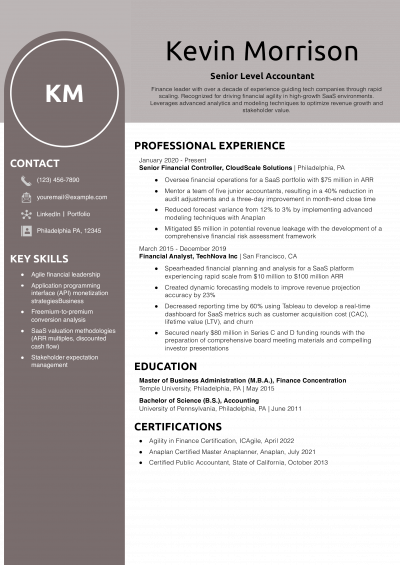

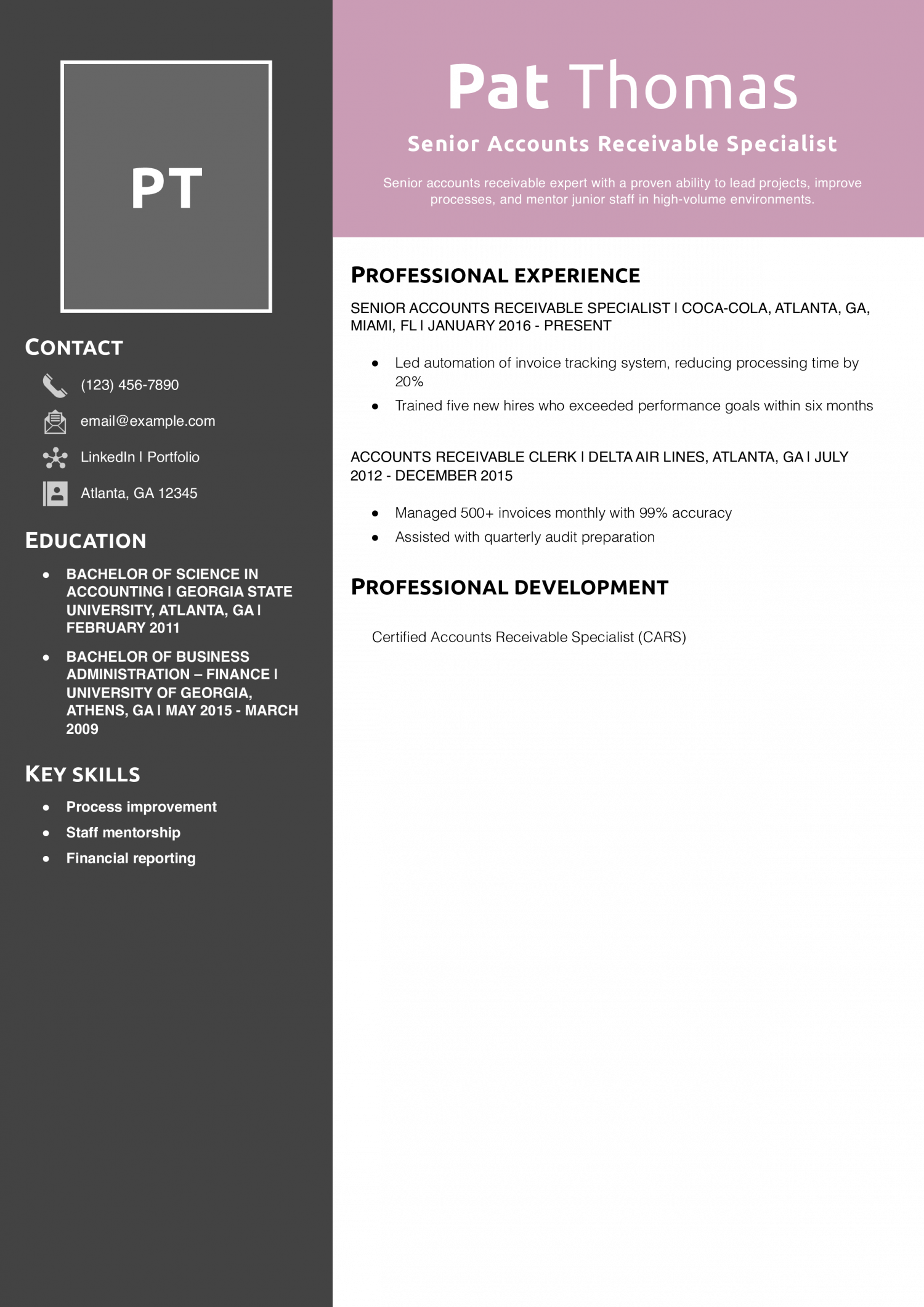

Senior Accounts Receivable Specialist Resume Example

Why This Resume Is a Great Example

Pat’s resume blends leadership skills with strong technical abilities, showing readiness for higher-level positions. Review more examples.

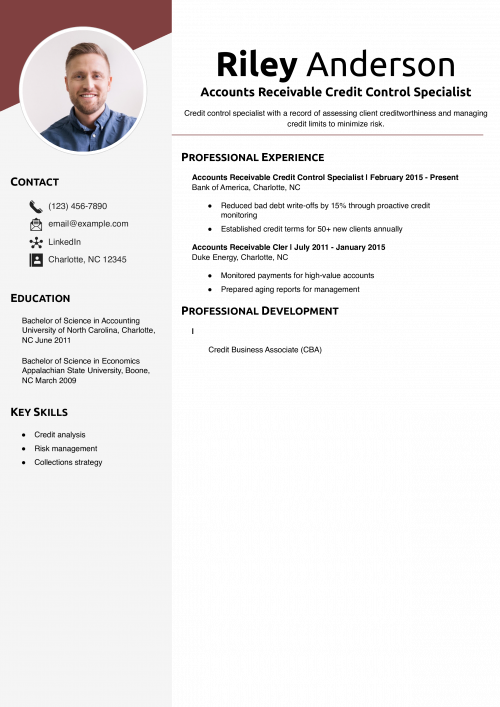

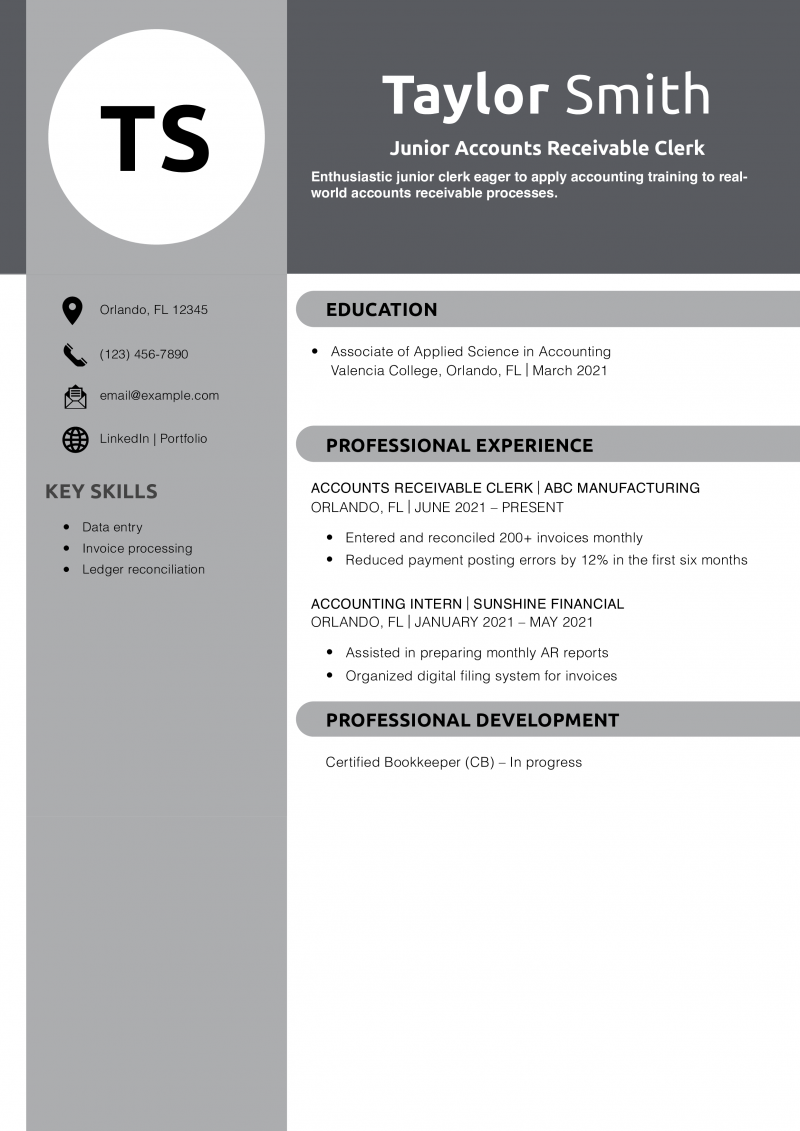

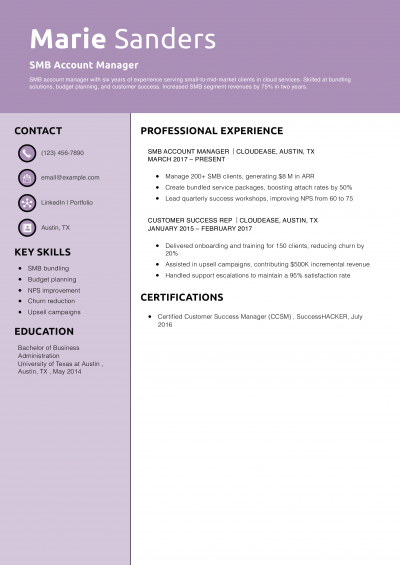

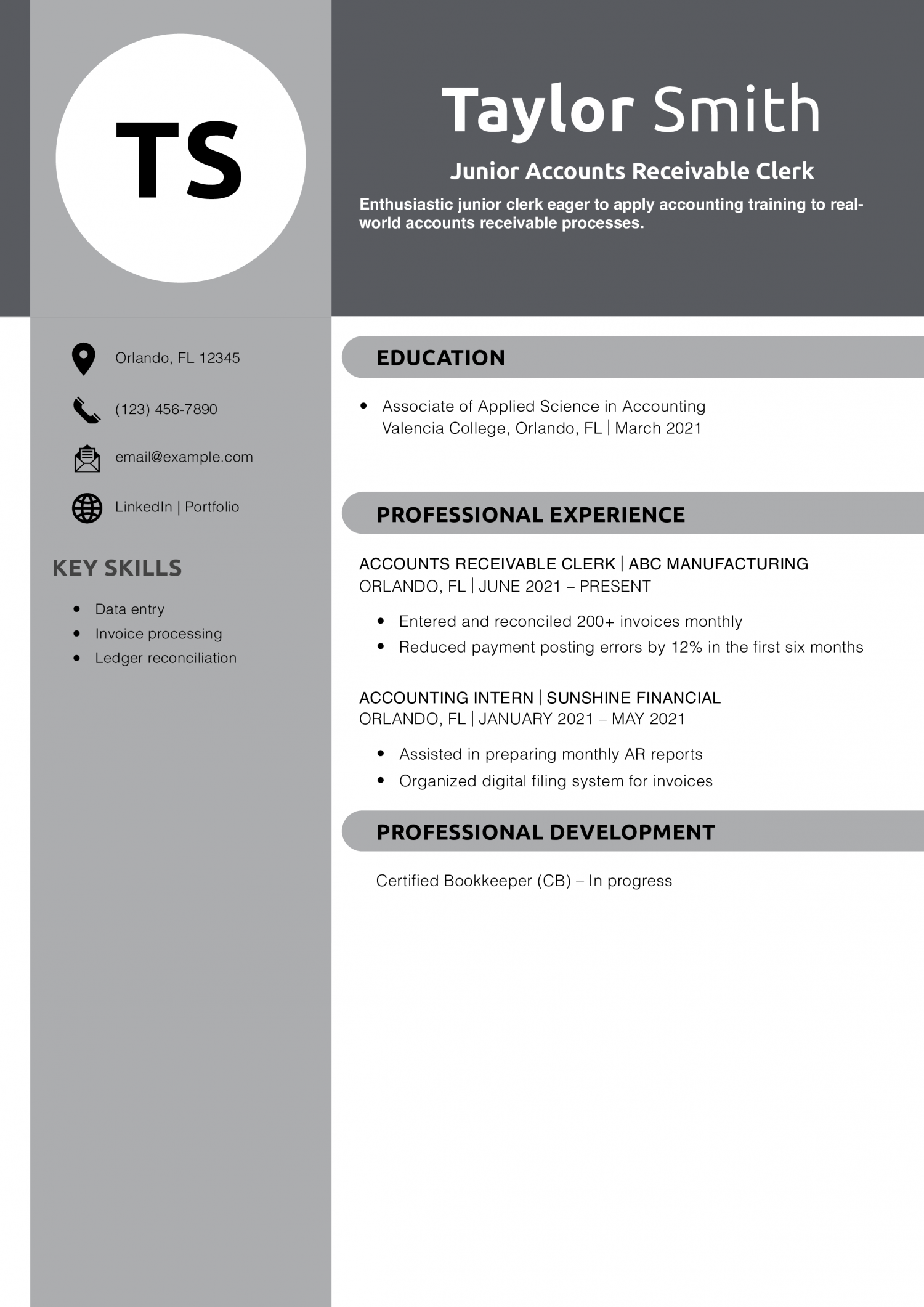

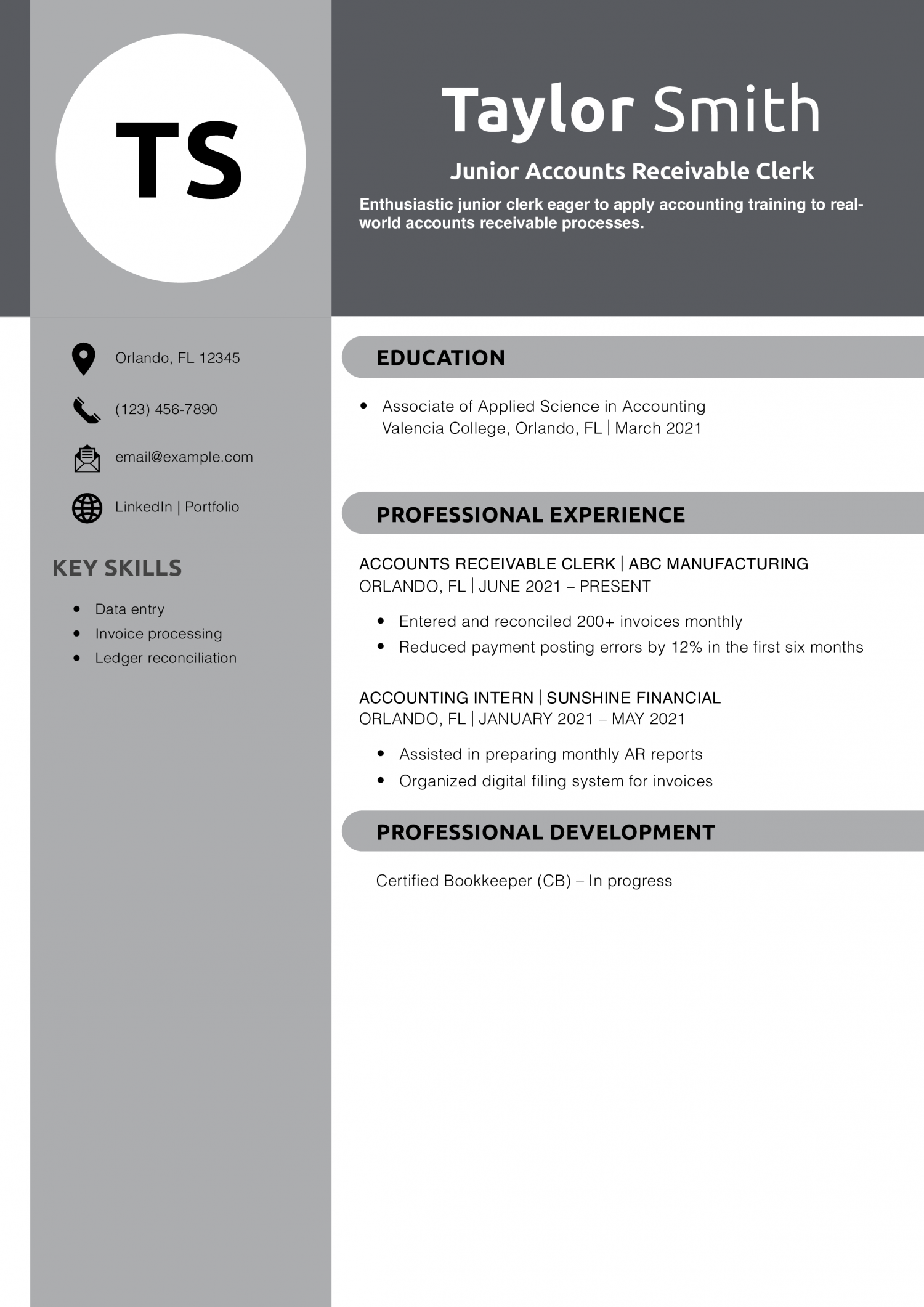

Junior Accounts Receivable Clerk Resume Example

Why This Resume Is a Great Example

Taylor’s resume focuses on recent education and measurable early career wins. Learn how to write a resume with no experience.

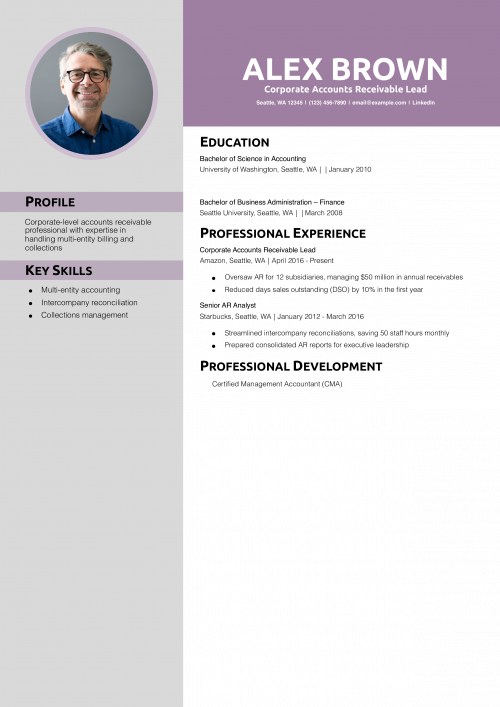

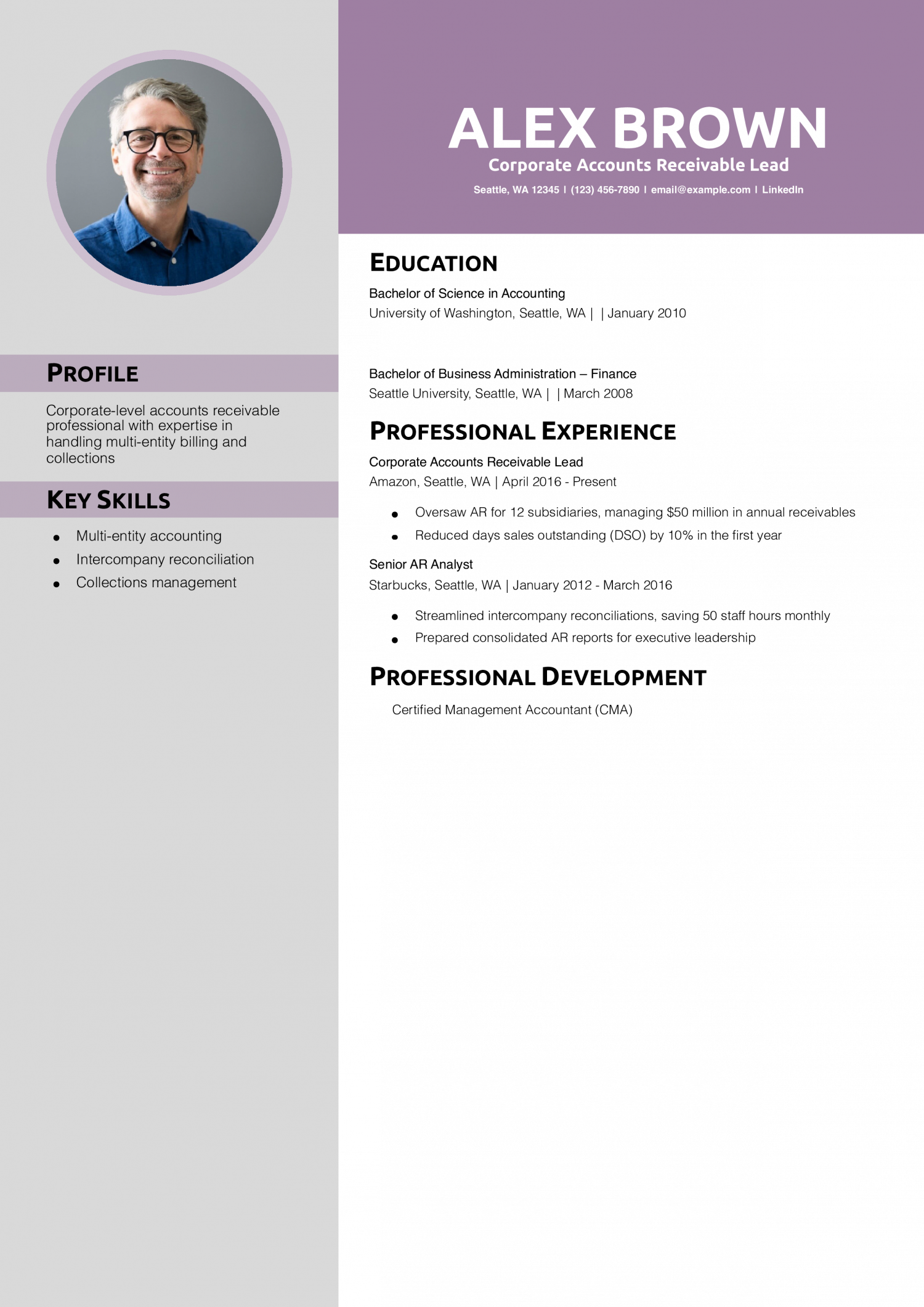

Corporate Accounts Receivable Lead Resume Example

Why This Resume Is a Great Example

Alex’s resume shows mastery of complex corporate AR operations. See our tips on showcasing advanced expertise.

Accounts Receivable Finance Specialist Resume Example

Why This Resume Is a Great Example

Jordan’s resume highlights both operational skills and financial analysis ability, ideal for hybrid finance roles. Discover how to integrate technical skills.

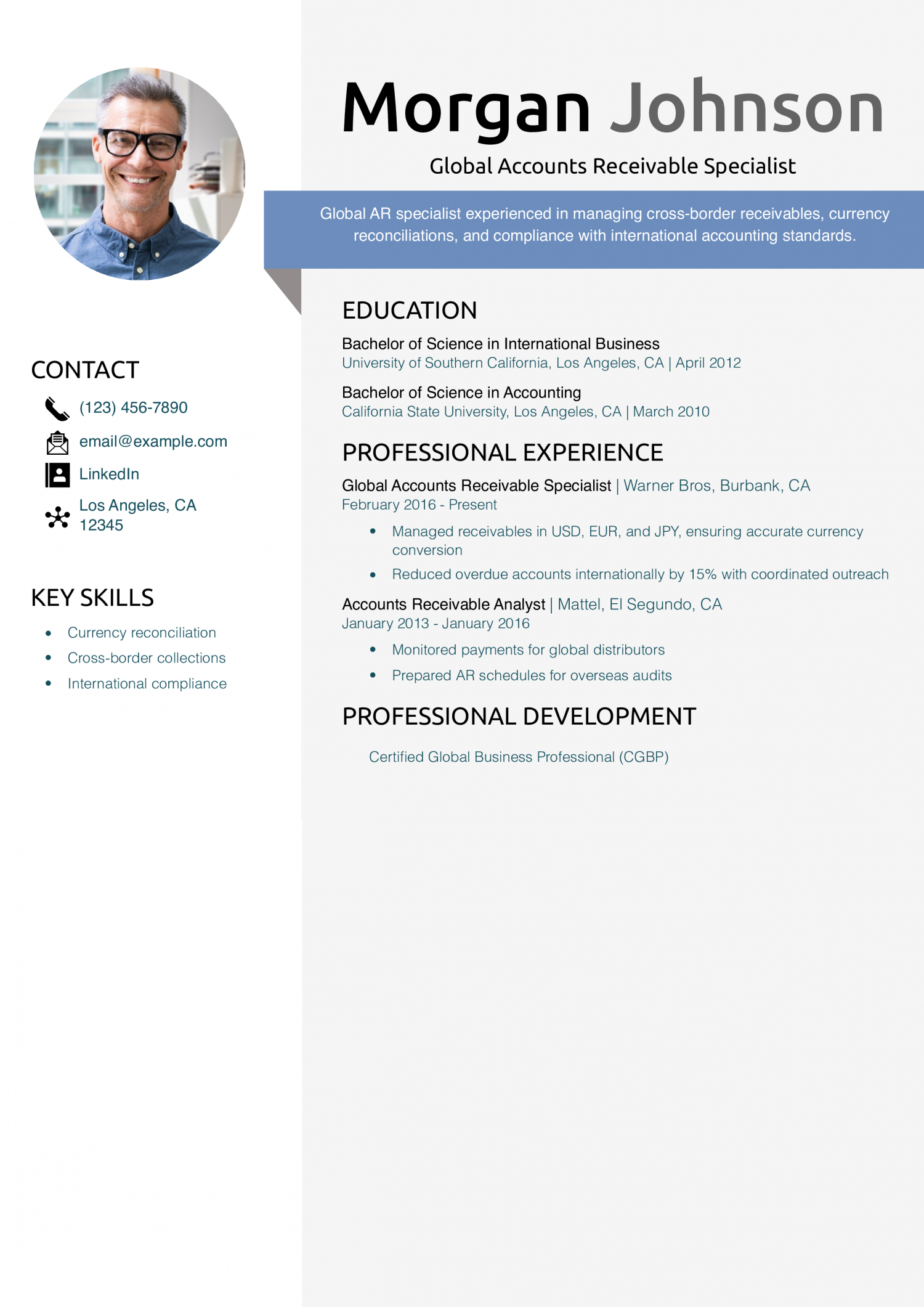

Global Accounts Receivable Specialist Resume Example

Why This Resume Is a Great Example

Morgan’s resume showcases international expertise and compliance awareness, perfect for multinational companies. Here is our guidance on highlighting specialized experience.

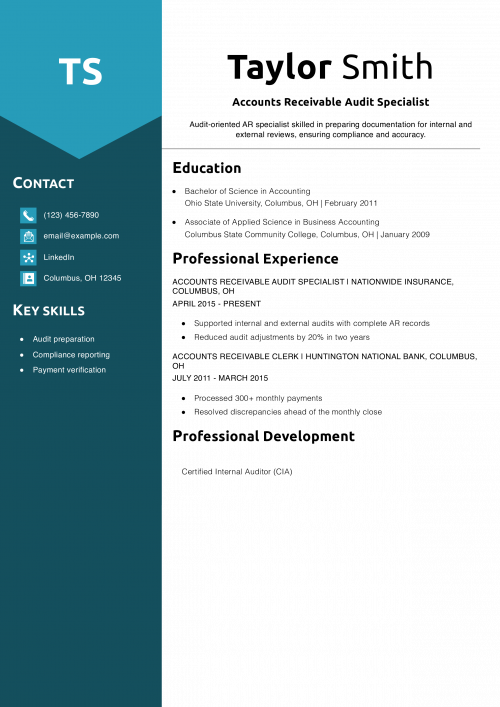

Accounts Receivable Audit Specialist Resume Example

Why This Resume Is a Great Example

Taylor’s resume emphasizes audit compliance, which adds trustworthiness in finance roles. Learn about structuring your skills for impact.

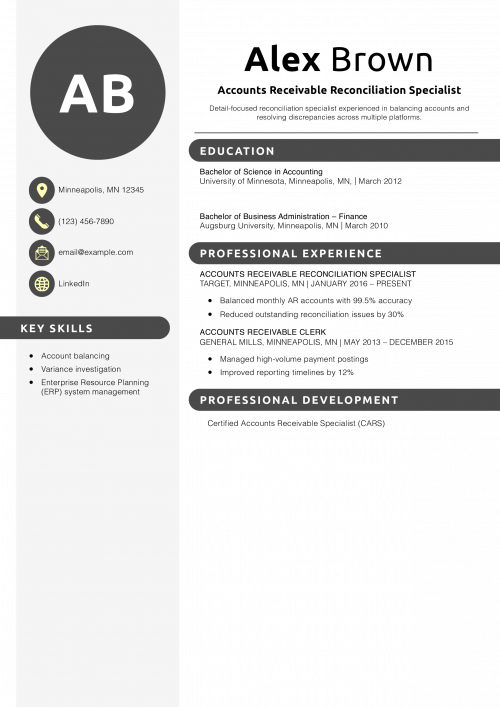

Accounts Receivable Reconciliation Specialist Resume Example

Why This Resume Is a Great Example

Alex’s resume focuses on accuracy and problem resolution, valuable in reconciliation roles. See more about tailoring skills for specific jobs.

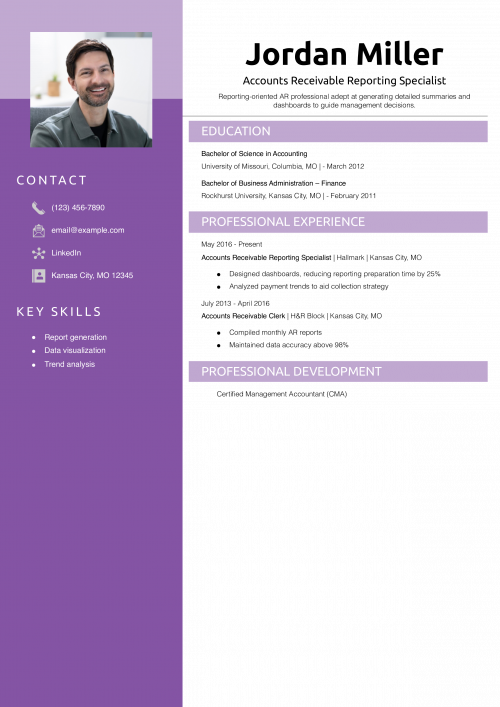

Accounts Receivable Reporting Specialist Resume Example

Why This Resume Is a Great Example

Jordan’s resume showcases clear contributions to decision-making through data reporting. Explore tips on making your resume stand out visually.

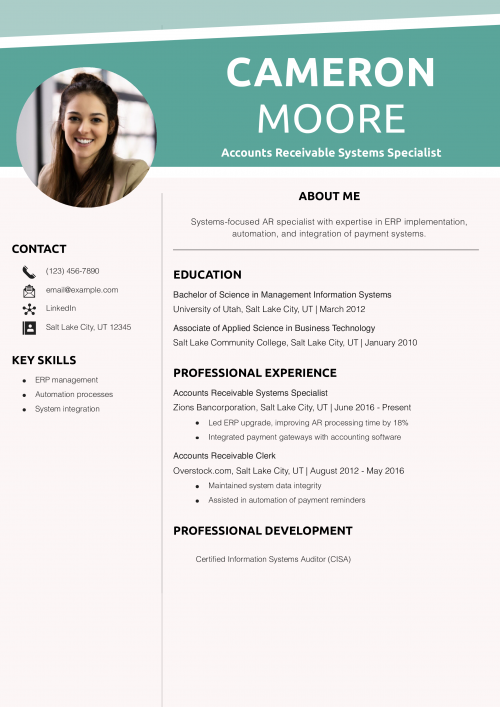

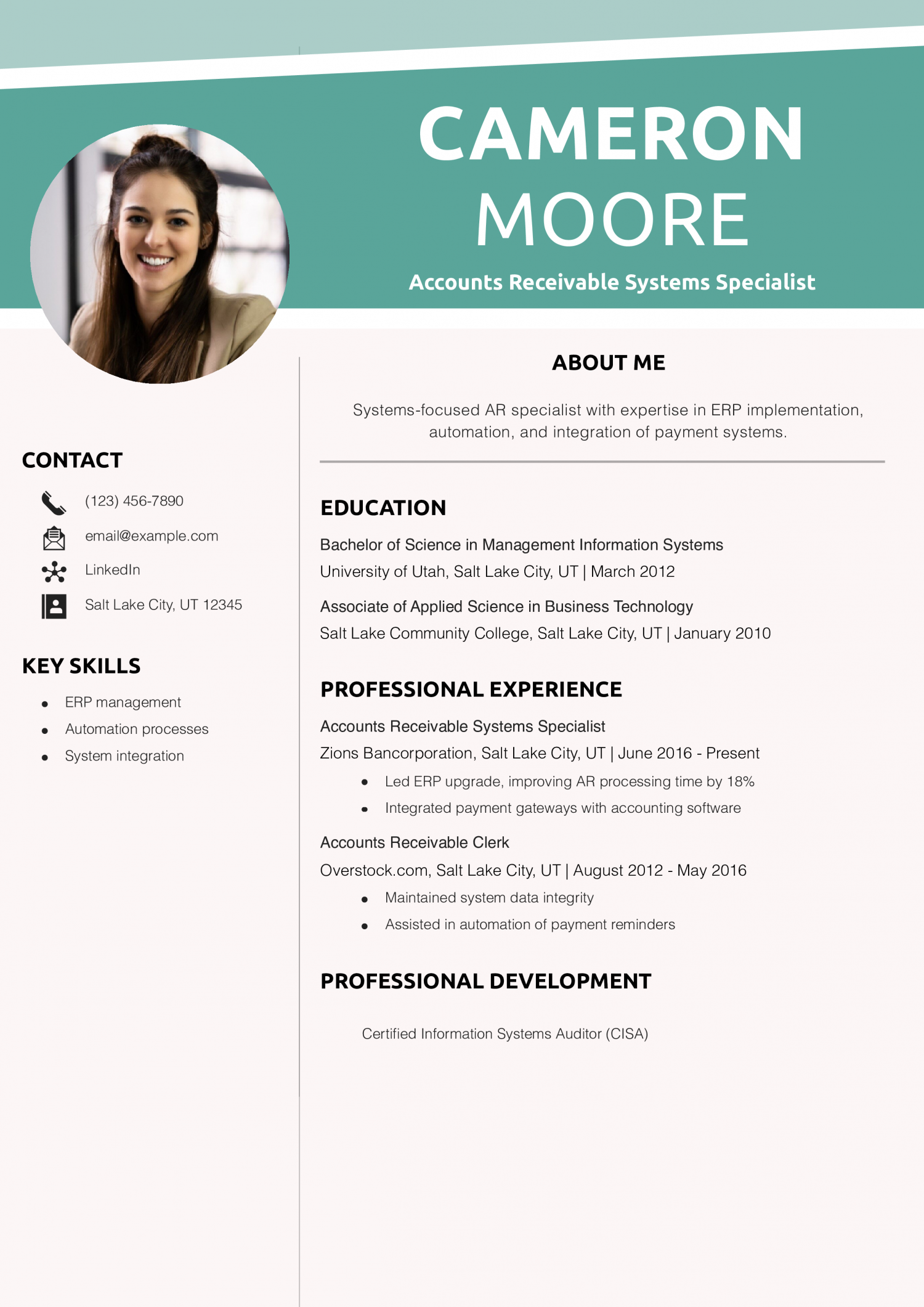

Accounts Receivable Systems Specialist Resume Example

Why This Resume Is a Great Example

Cameron’s resume reflects technical expertise rare in AR roles, adding unique value. Learn about combining IT and finance skills.

Accounts Receivable Credit Control Specialist Resume Example

Why This Resume Is a Great Example

Riley’s resume highlights risk reduction achievements and strategic oversight. See how to showcase financial impact.

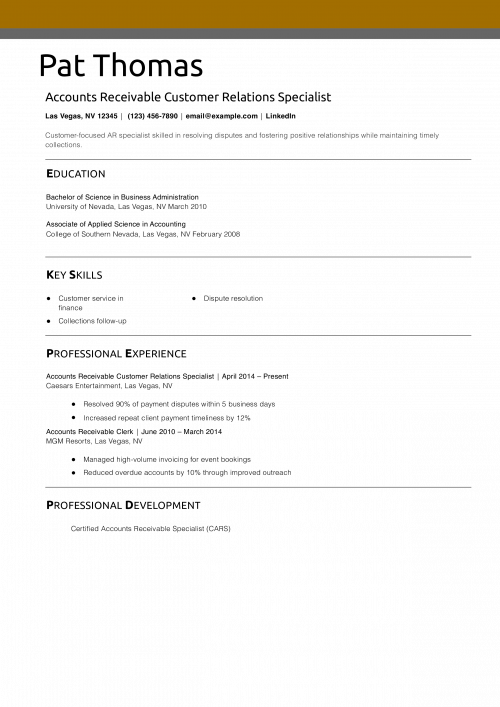

Accounts Receivable Customer Relations Specialist Resume Example

Why This Resume Is a Great Example

Pat’s resume demonstrates an ability to merge financial skill with client care, valuable in service industries. Dive into how to feature soft skills effectively.

Accounts Receivable Text-Only Resume Examples and Templates

How To Write an Accounts Receivable Resume

Using a template can help you write an effective accounts receivable resume. Your accounts receivable resume should usually include these sections:

- Contact information

- Profile

- Key skills

- Professional experience

- Education and certifications

Before starting work on your resume, jot down your preferences for your target job duties, industry, company size, or work culture. These notes will help you determine and emphasize your best career details as you develop each section.

1. Share your contact information

Give your full name, phone number, email address, location, and links to any online professional profiles. Ensure your current contact information so employers can reach you for an interview.

Example

Your Name

(123) 456-7890 | [email protected] | City, State Abbreviation Zip Code | LinkedIn

2. Summarize your accounts receivable qualifications in a dynamic profile

Impress hiring managers at the top of your resume by giving the three to five primary reasons you can excel as their next accounts receivable hire. These key selling points may include your:

- Years of related work experience

- Work style or approach (efficient, diligent, collaborative…)

- College degree(s) or certifications in your field

Example

Highly skilled accounts receivable clerk with a strong educational background in accounting and finance, and over four years of experience in top accounting firms like Deloitte and PwC. Proven track record in processing high volumes of incoming payments, reconciling accounts receivable ledgers, and managing customer communications effectively. Holds certifications as a Certified Bookkeeper (CB), Certified Accounts Receivable Specialist (CARS), and Certified Public Accountant (CPA), demonstrating proficiency in accounting software, knowledge of basic accounting principles, and strong data entry skills.

3. Add your accounts receivable experience with compelling examples

View the experience section as a chance to give examples of your work and success in roles similar to the one you’re pursuing. For each job in your recent work history, brainstorm your duties and achievements on a separate document or sheet of paper. Then, choose the most relevant details to feature as bullet points in this section.

Example

Senior Accounts Receivable Specialist

Deloitte

Philadelphia, PA | June 2017 to present

- Oversee a team of five accounts receivable specialists, ensuring accurate and timely processing of over 1000 invoices monthly

- Reduced outstanding receivables by 30% through the implementation of effective collection strategies

- Developed and implemented a new process for tracking and resolving payment discrepancies, improving efficiency by 25%

Resume writer’s tip: Quantify your experience

When possible, use relevant performance data and metrics to show the results you’ve achieved in accounts receivable. Hard numbers put your work in context and give recruiters a better sense of your scope and impact.

Do

- "Conducted account research to identify and correct errors, improving the overall accuracy of financial records by 25%"

Don’t

- "Conducted account research to identify and correct errors, improving the overall accuracy of financial records "

Resume writer's tip: Tailor your resume to each application

For each job posting you respond to, note any details about the hiring organization’s size, industry, customer base, or products and services. How do these areas compare to your recent experience? You can make a stronger first impression on the hiring manager by citing these similarities in your profile.

For instance, say the company is in manufacturing. You could enhance your profile by changing your first line from “Manager with seven years of experience” to “Manager with seven years of experience, including three years in manufacturing.”

What if you need to gain experience in accounts receivable?

Don’t worry. As long as the job posting doesn’t strictly require it, you don’t need direct work experience to write an effective resume. The trick is focusing on your transferable skills, which can come from various areas such as your past jobs, internships, volunteer positions, or college courses. By detailing these areas in full on your resume, you can ensure it helps you get interviews for your target job.

4. Include accounts receivable-related education and certifications

With the education and certifications sections, you can show you have a solid knowledge base in your field. Cite any credentials you’ve earned that speak to your expertise in accounts receivable. The following templates help you organize this information on your resume (note, years are optional).

Education

Template:

[Degree Name], [School Name], [City, State Abbreviation] | [Graduation Year]

[Relevant coursework or honors]

Example:

Bachelor of Science in Accounting, University of Pennsylvania, Philadelphia, PA

Certifications

Template:

[Certification Name],, [Awarding Organization] | [Completion Year]

Example:

Certified Accounts Receivable Specialist (CARS), The American Accounts Receivable Institute

5. Include a list of skills and proficiencies related to accounts receivable

A separate skills section lets you quickly display the (possibly various) ways you can add value to an organization. Below, you’ll find some key terms and skills to consider for this section:

| Key Skills and Proficiencies | |

|---|---|

| Accounts receivable procedures | Account reconciliation |

| Collections process improvement | Cross-team collaboration |

| Data entry and analysis | Payment processing |

| Reporting and documentation | Task prioritization |

| Team leadership and motivation | |

Resume writer's tip: Use common action verbs

One of the best ways to enhance your resume is by starting each bullet point with a strong action verb. Dynamic verbs help you keep the hiring manager’s attention and show the varied nature of your experience.

The following list can help you find a good mix of action verbs for your accounts receivable resume:

| Action Verbs | |

|---|---|

| Created | Decreased |

| Enhanced | Formalized |

| Fostered | Generated |

| Grew | Improved |

| Increased | Introduced |

| Lowered | Managed |

| Organized | Prevented |

| Ranked | Reduced |

| Resolved | Streamlined |

| Updated | Verified |

| Won | |

How To Pick the Best Accounts Receivable Resume Template

A resume is a simple tool for professional communication and should be formatted accordingly. Choose a clear and straightforward template, and avoid any template with elaborate graphics or various colors and font styles. Simple resume design helps a hiring manager scan for relevant information. It also enables you to tailor the document to each job application and update your work history.

Frequently Asked Questions: Accounts Receivable Resume Examples and Advice

First, look closely at the job post text and note repeated or emphasized words. Compare these phrases to the language you're using in your resume, particularly the profile and key skills sections. Then, seek ways to align your resume language with the job posting while not copying phrases or misstating your background.

For example, if the organization seeks someone collaborative, call out that aspect of your experience in your profile. Or say the company has many non-English speaking customers. Cite your foreign language skills in your profile and as a separate section farther down the document. With adjustments like these, you can make your resume more relevant to each opportunity.

Most accounts receivable professionals should use the combination (or hybrid) format. True to its name, this format combines two important features of other resume formats: the chronological format's experience section and the functional format's profile section. (The resume examples on this page all use combination format.)

A combination resume offers the best of both worlds by fusing these features. The experience section lets you outline your recent work history - essential information for most employers. At the same time, the profile section enables you to display your career highlights at the top, whether they're from that work history or another part of your background.

As a result, you can present yourself clearly and strategically. This format gives hiring managers the best view of your experience and relevant strengths so they can decide whether to call you for an interview.

To optimize your Accounts Receivable CV for ATS, make sure to incorporate the right keywords from the job description, especially in sections like skills, experience, and certifications. Stick to a clean, straightforward layout that avoids complicated formatting or images, as these can confuse the ATS. This will help your CV get past the automated systems and into the hands of hiring managers.

Include a cover letter with your resume

A good cover letter can enhance your job application. To write a standout letter, get specific. Tell the hiring manager why you’re interested in their organization and the accounts receivable role they hope to fill.

Check Out Related Examples

Resume Templates offers HR approved resume templates to help you create a professional resume in minutes. Choose from several template options and even pre-populate a resume from your profile.