As a finance professional, your resume must reflect expertise in money management. Highlight your proficiency in things like financial analysis, risk assessment, and strategic decision-making skills. This guide provides expert insights and examples to help you write a finance resume that shows you would be a valuable asset to any organization.

Key Takeaways

- Emphasize specializations: Finance professionals can specialize in different business roles, from accounting to financial planning to investment banking and more. Your resume should be specific about your financial skills, including the software you use, degrees and certifications you have, and other details.

- Detail quantifiable achievements: Quantifying your accomplishments can help potential employers understand the value that you bring. Share any numbers you can, whether it’s how you saved your team money, increased return on investment (ROI), or achieved a strong accuracy or customer service rating.

- Use keywords for ATS: Using some of the same keywords and phrases from job descriptions can help ensure that your resume is selected by applicant tracking systems (ATS). This can help you make it to the human phase of the job search.

Most Popular Finance Resumes

Entry-Level Finance Associate Resume Example

Why This Resume Is a Great Example

This resume clearly demonstrates foundational finance skills and internship accomplishments, showcasing the candidate’s readiness to step into a full-time finance role. The structure places relevant experience front and center, making it easy for recruiters to see how the candidate’s academic background translates into practical contributions.

Key Tips

Quantify your achievements when possible. Even in early roles, including numbers like “contributed to a 10% budget variance reduction,” can illustrate impact. For more guidance on structuring your resume, check out Best Resume Formats.

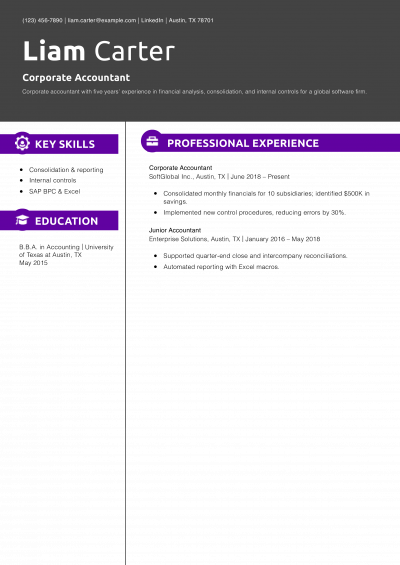

Senior Financial Analyst Resume Example

Why This Resume Is a Great Example

By highlighting clear, measurable achievements, such as efficiency gains and risk mitigation, this resume showcases the candidate’s impact on business performance. The reverse-chronological format ensures the freshest experience is front and center.

Key Tips

Use quantifiable metrics to demonstrate impact: citing percentages and dollar amounts helps employers visualize your contributions. For more ideas on choosing the right skills, see Skills to Put on Resume.

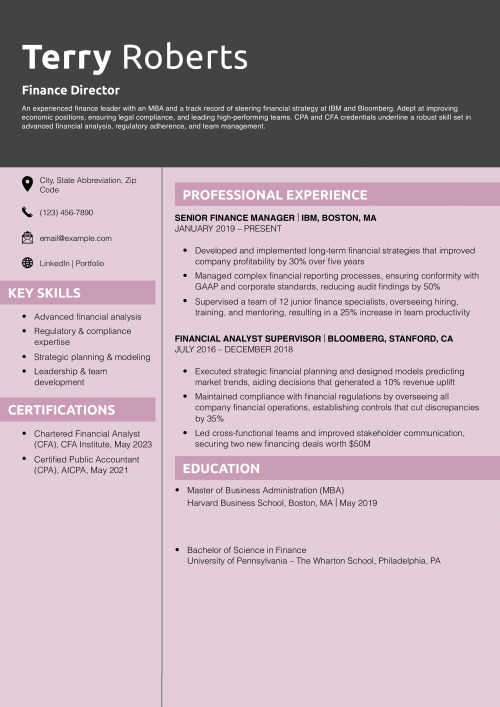

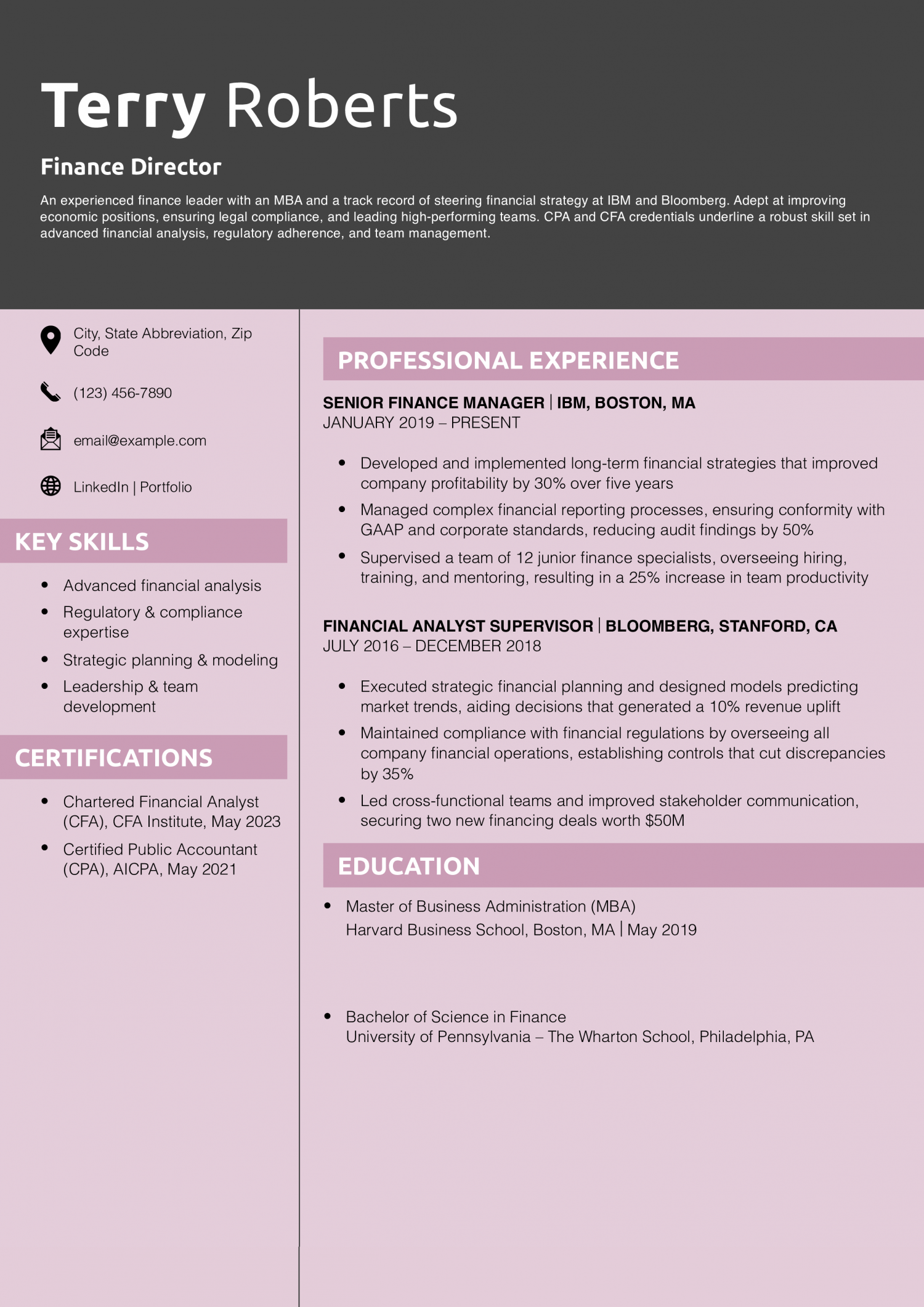

Finance Director Resume Example

Why This Resume Is a Great Example

By focusing on strategic outcomes (e.g., 30% profitability improvement) and compliance achievements, this resume highlights both leadership and technical acumen. The executive-level synopsis in the profile immediately conveys a high level of expertise.

Key Tips

Lead with metrics whenever possible: showcasing percentage improvements and cost savings reinforces the strategic value you bring. For guidance on crafting a compelling summary, check out How to Write a Resume Summary.

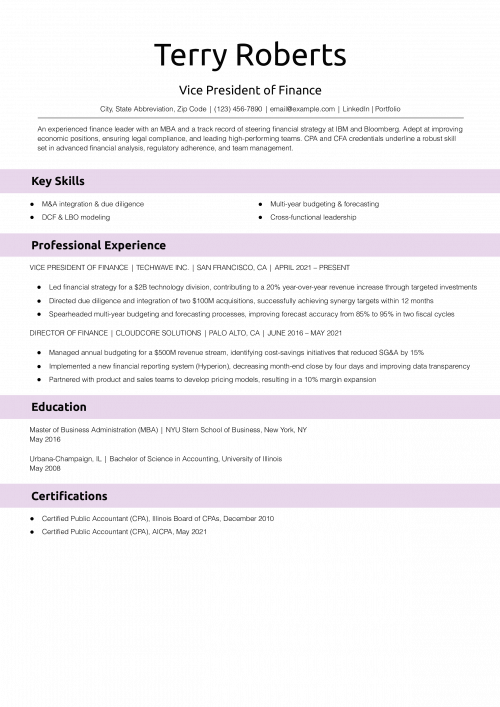

Vice President of Finance Resume Example

Why This Resume Is a Great Example

Emphasizing C-suite collaboration, M&A successes, and measurable budget improvements aligns achievements with company scale, conveying broad responsibility and impact.

Key Tips

Highlight high-level metrics and outcomes: noting percentages and dollar figures helps illustrate strategic leadership. For advice on structuring executive resumes, see Best Resume Formats.

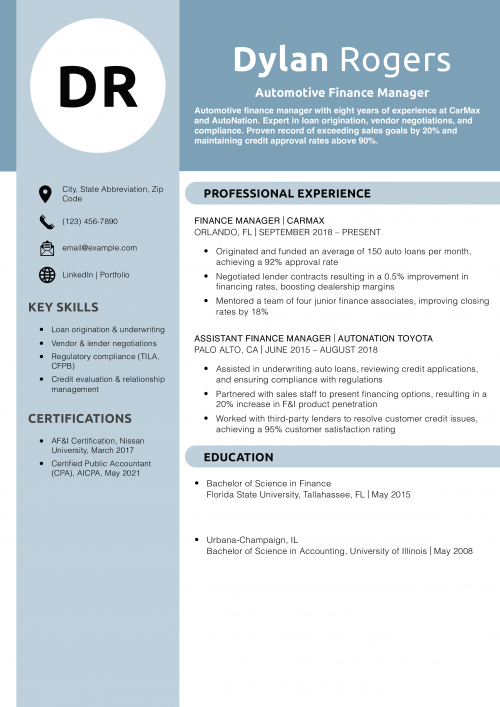

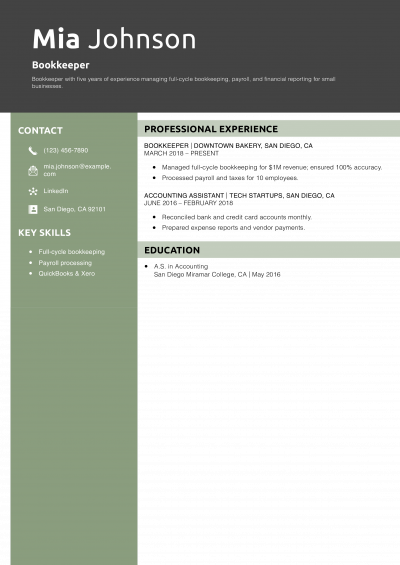

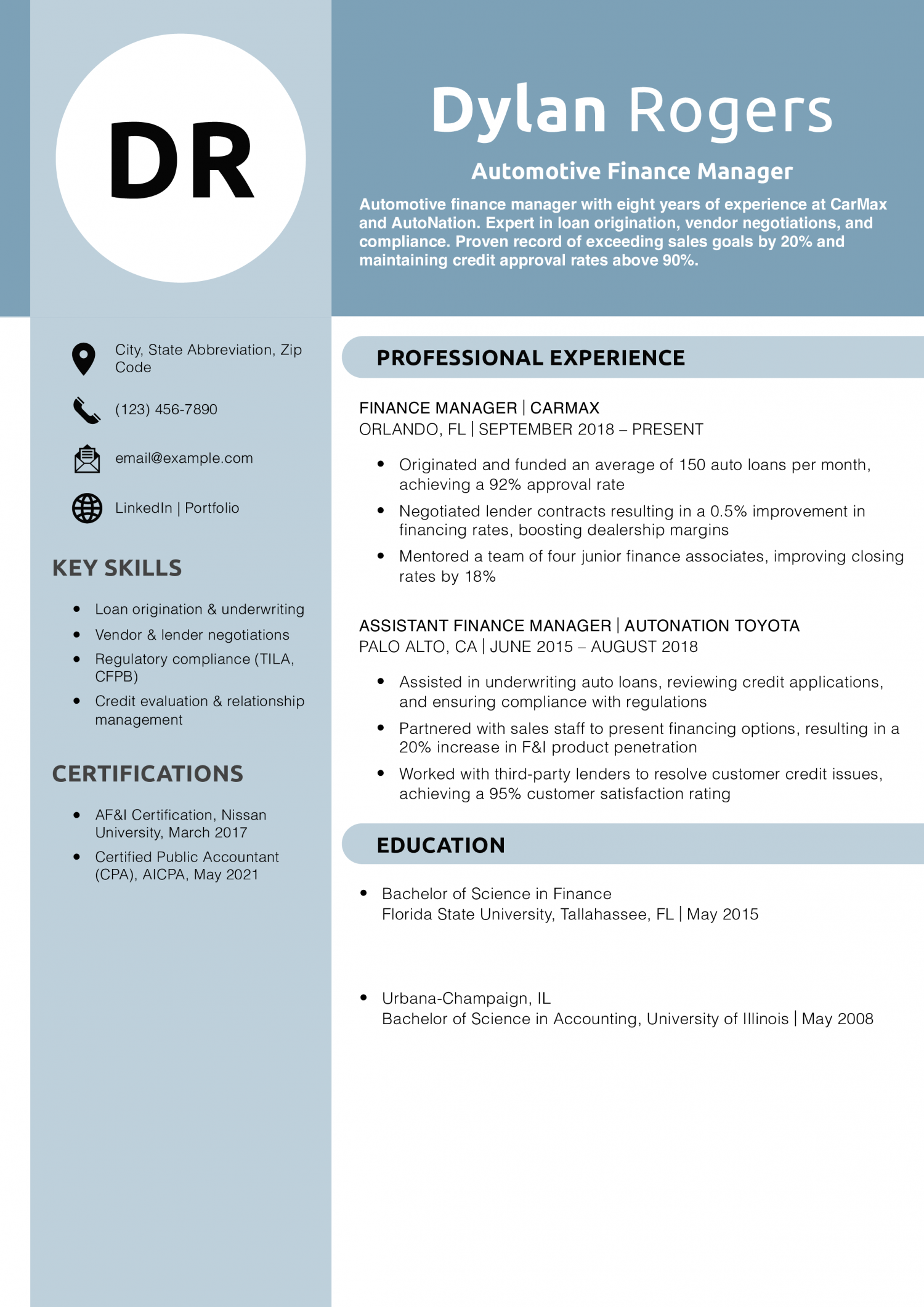

Automotive Finance Manager Resume Example

Why This Resume Is a Great Example

Clear metrics on loan volumes and approval rates demonstrate this candidate’s direct impact on profitability. The profile immediately establishes industry expertise.

Key Tips

Use concrete numbers: including loan volumes and approval percentages quantifies your success. For skill recommendations, see Skills to Put on Resume.

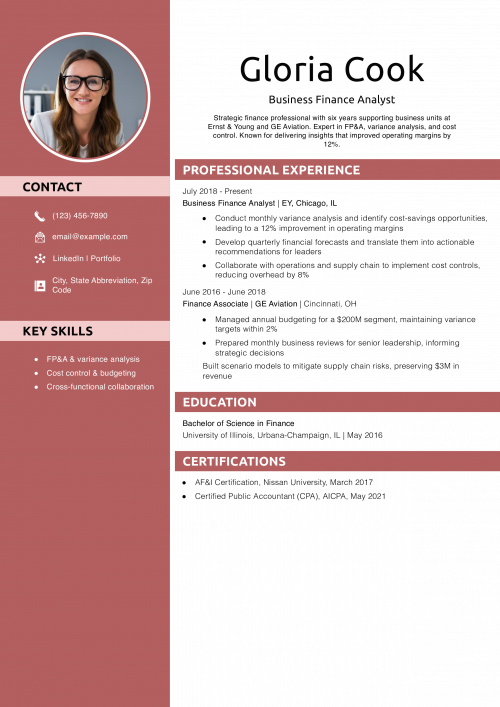

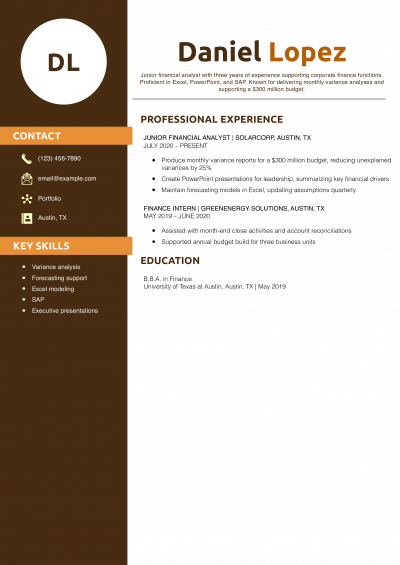

Business Finance Analyst Resume Example

Why This Resume Is a Great Example

The candidate quantifies margin improvements and cost savings, demonstrating ability to partner with operations and drive results. The structure emphasizes strategic insights.

Key Tips

Emphasize collaborative achievements: showing how you drove cross-functional impact highlights broader business value. For profile tips, see How to Write a Resume Summary.

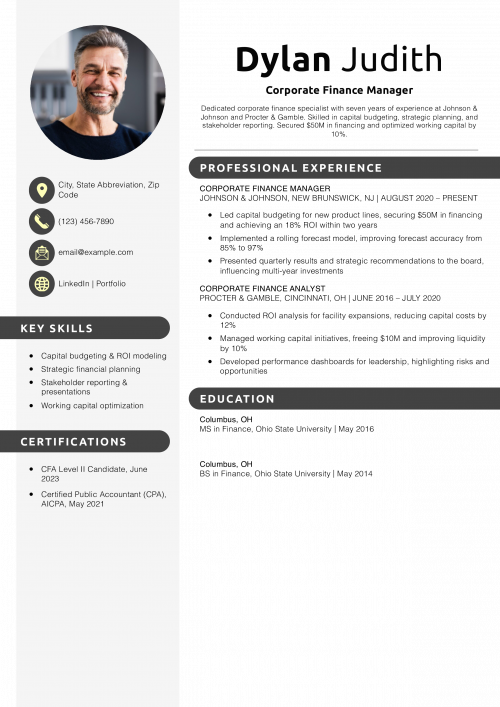

Corporate Finance Manager Resume Example

Why This Resume Is a Great Example

Referencing large-scale financing deals and working capital results shows strategic corporate impact. The reverse-chronological format highlights progressive responsibility.

Key Tips

Include high-value achievements: referencing multi-million-dollar financing helps recruiters understand your strategic reach. For education guidance, see How to List Education on a Resume.

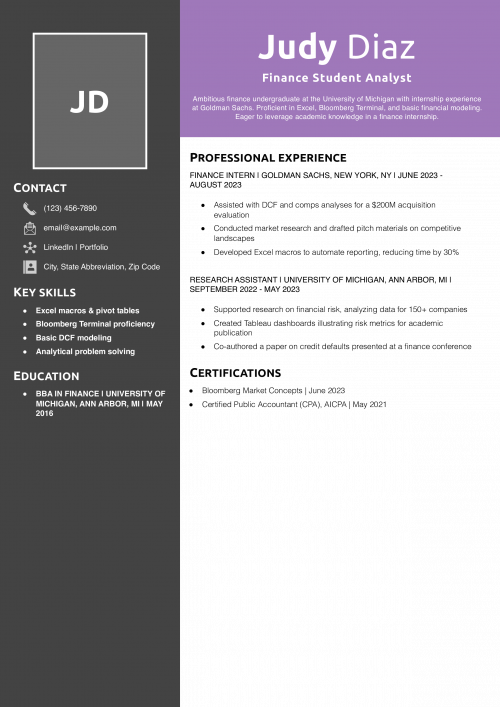

Finance Student Analyst Resume Example

Why This Resume Is a Great Example

Showcases hands-on finance experience—M&A analysis at Goldman and academic research—and lists technical tools, emphasizing readiness.

Key Tips

List technical proficiencies: naming specific software tools sets you apart. For student-focused best practices, see How a Resume Should Look for a College Student.

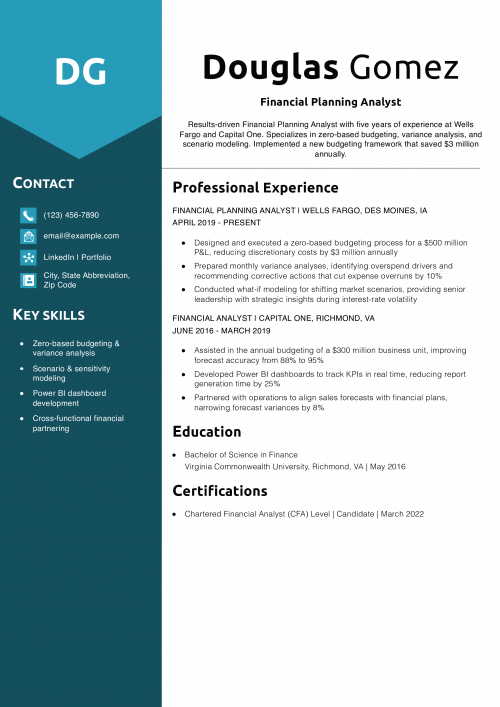

Financial Planning Analyst Resume Example

Why This Resume Is a Great Example

By quantifying a $3 million cost saving and forecast accuracy improvements, this resume highlights both tactical budgeting and strategic modeling capabilities. The clear metrics and tools showcase readiness for senior FP&A roles.

Key Tips

Highlight your process improvements with hard numbers, dollar savings or percentage gains catch recruiters’ eyes. For more on financial modeling best practices, see How to Write a Resume Summary.

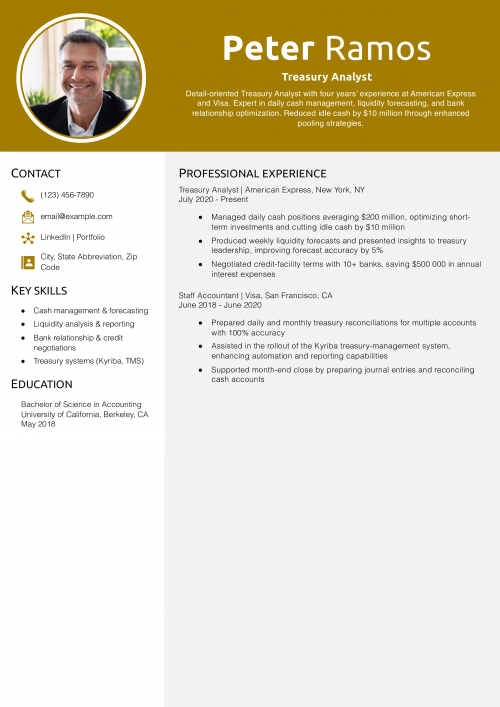

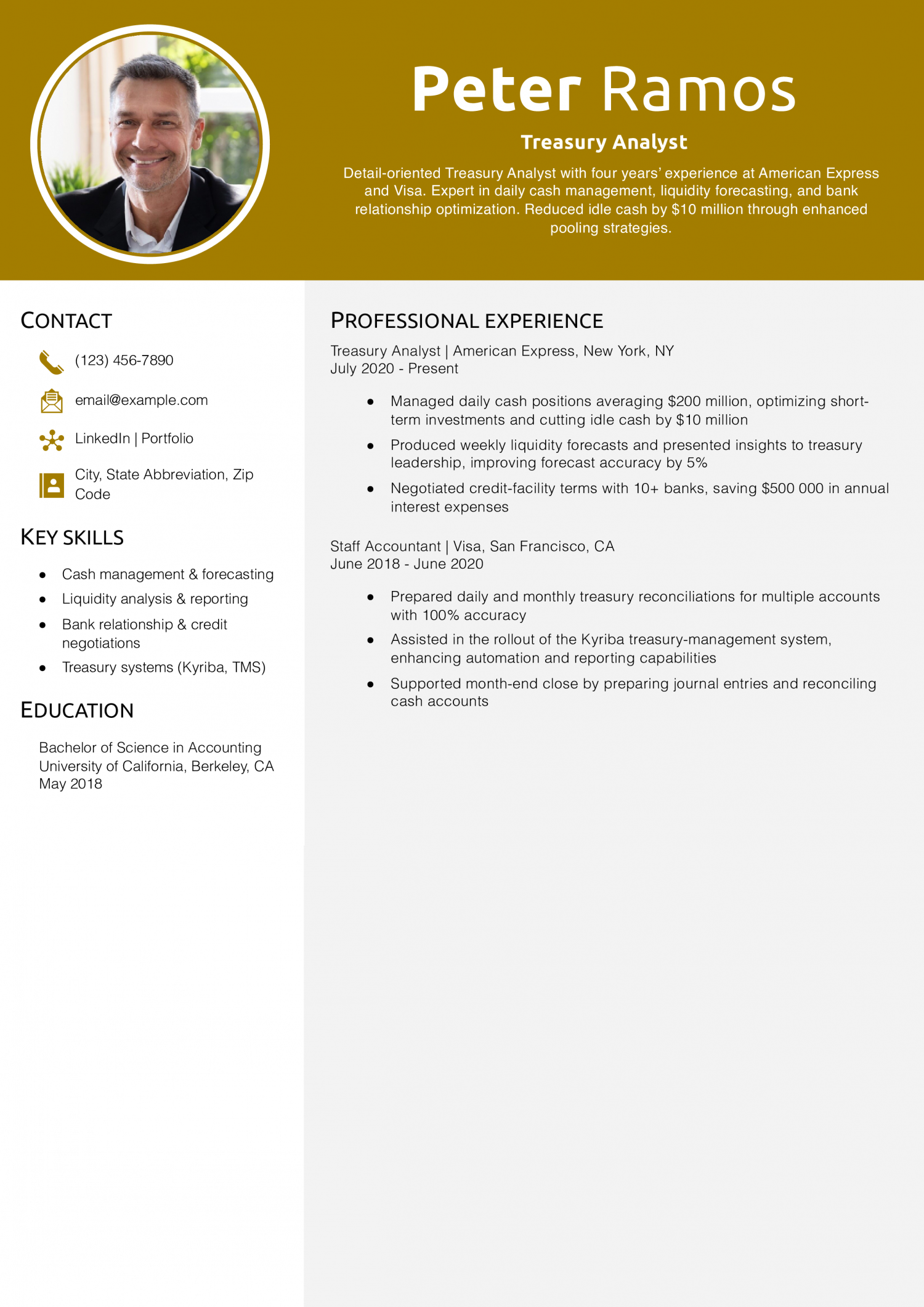

Treasury Analyst Resume Example

Why This Resume Is a Great Example

This resume quantifies a $10 million cash reduction and cost savings, demonstrating tangible treasury expertise and system implementation experience.

Key Tips

Showcase both numbers and tools: combining dollar-impact figures with system names highlights technical and strategic strengths. For guidance on compliance language, see How to Tailor Resume to Job Description.

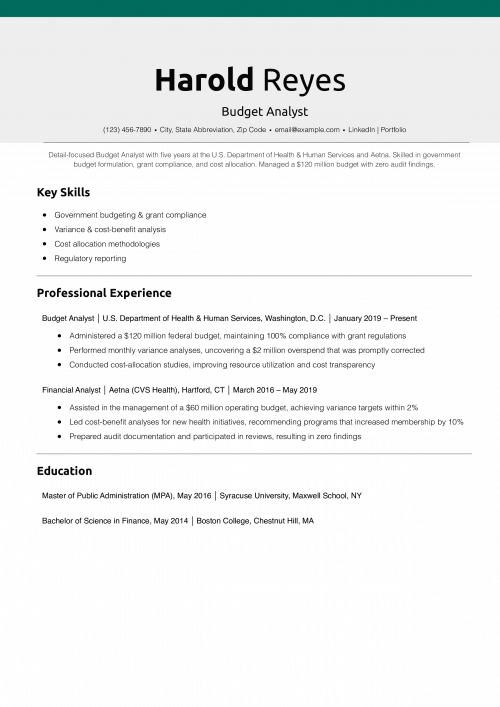

Budget Analyst Resume Example

Why This Resume Is a Great Example

Quantifying management of a $120 million budget and zero audit findings underscores mastery of public-sector finance and compliance.

Key Tips

In government roles, highlight regulatory success. Examples like zero audit findings signal reliability. For advice on structuring compliance details, see Career Advice: Resume Job Description.

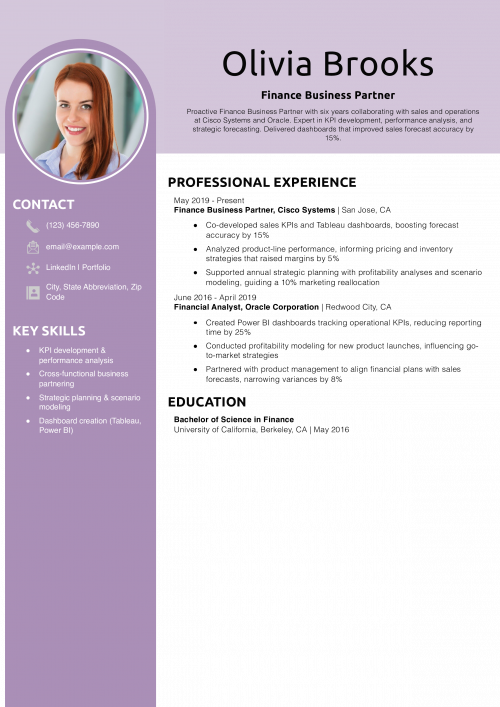

Finance Business Partner Resume Example

Why This Resume Is a Great Example

Emphasizing cross-functional impact and measurable forecast improvements illustrates the candidate’s ability to drive business results.

Key Tips

Highlight collaboration outcomes, such as partnering with sales and product teams, which underscores strategic influence. For resume keyword best practices, see Best Resume Keywords For Your Resume.

Financial Controller Resume Example

Why This Resume Is a Great Example

Highlighting both process automation savings and control-related cost avoidance showcases operational and compliance excellence.

Key Tips

Feature process improvements with metrics, like close-time reductions and prevented discrepancies demonstrate value. For powerful language to use on your resume, see Resume Action Words.

Corporate Treasurer Resume Example

Why This Resume Is a Great Example

Combines high-level debt negotiations with improved forecasting accuracy, demonstrating both strategic and technical treasury leadership.

Key Tips

Showcase financing successes with dollar amounts, credit facility size, and interest savings highlight impact. For resume best practices, see Best Leadership Skills For Your Resume

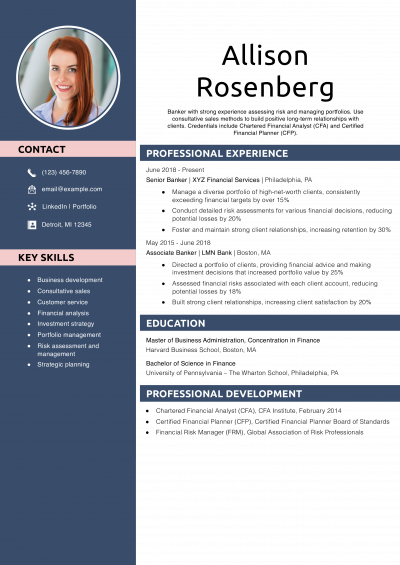

Asset Management Analyst Resume Example

Why This Resume Is a Great Example

The resume quantifies portfolio outperformance and process efficiencies, showing both investment acumen and technical prowess.

Key Tips

Highlight both return metrics and automation improvements to stand out. For more on highlighting your professional experience, see Work Experience on a Resume.

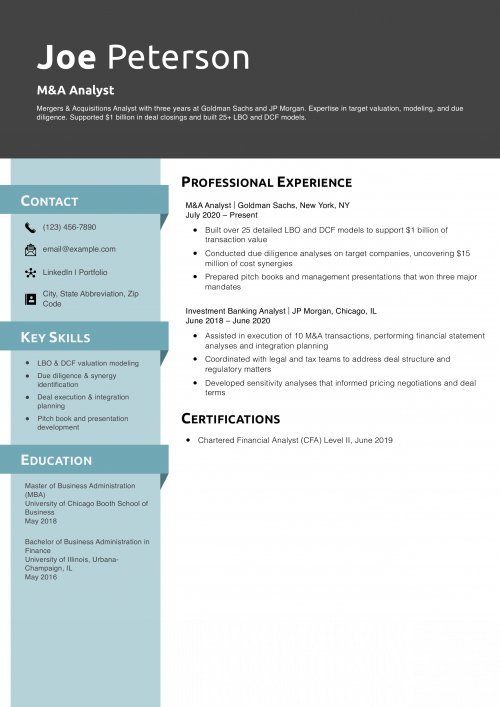

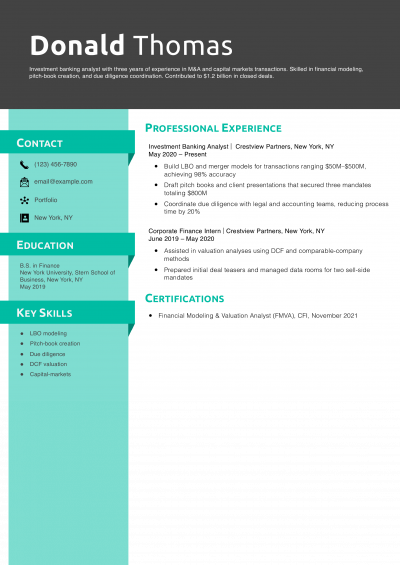

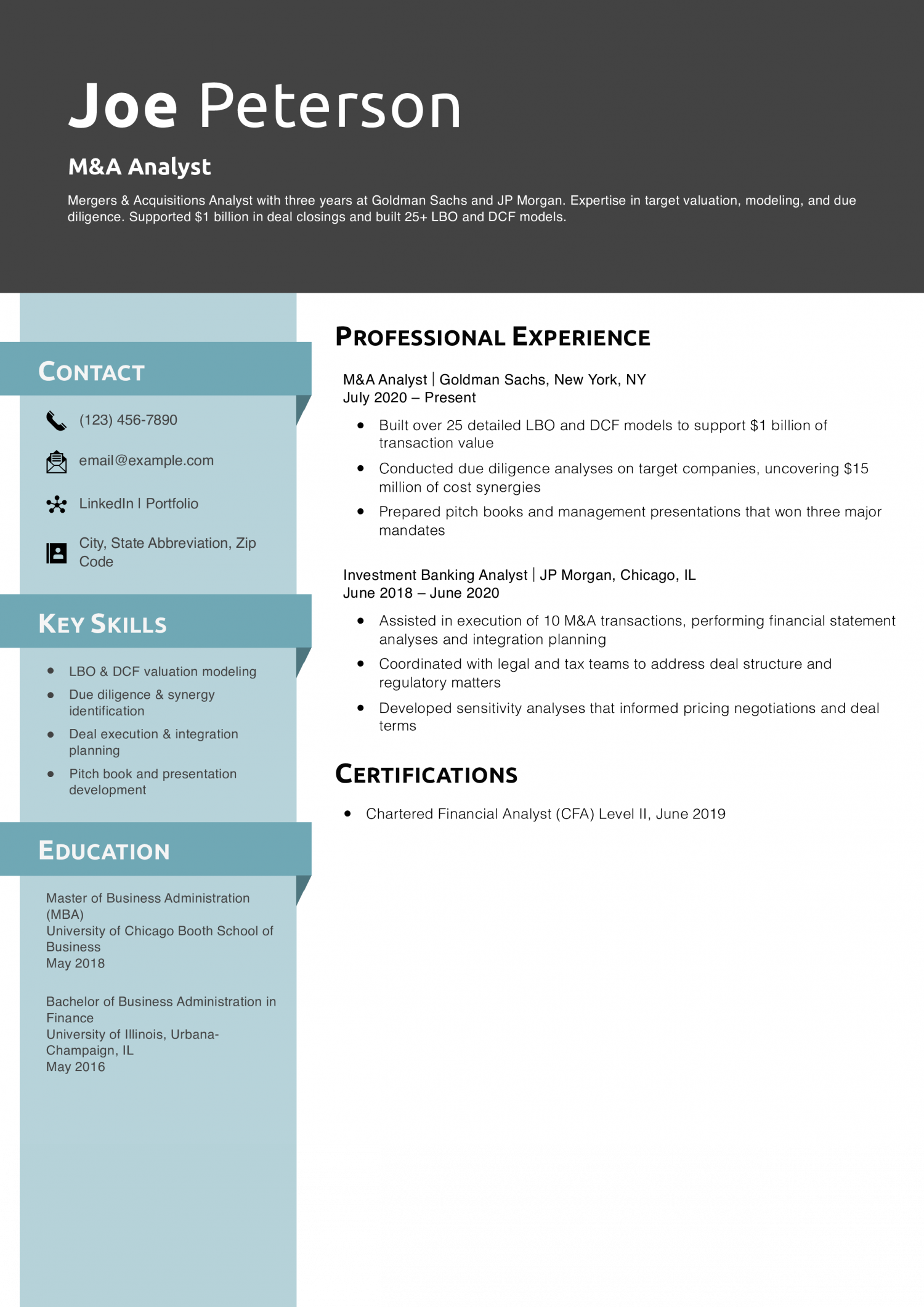

M&A Analyst Resume Example

Why This Resume Is a Great Example

This resume highlights concrete deal experience, such as $1 billion of closings, which models volume, demonstrating both technical skill and transaction acumen.

Key Tips

Quantify deal value and model counts to showcase depth. For structuring M&A resumes, see Best Resume Formats.

Private Equity Associate Resume Example

Why This Resume Is a Great Example

Quantifying invested capital and IRR highlights outcome orientation, while portfolio monitoring metrics demonstrate ongoing value-creation.

Key Tips

Lead with performance metrics — IRR and EBITDA improvements often resonate with PE recruiters. For profile tips, see How to Write a Convincing Resume Profile.

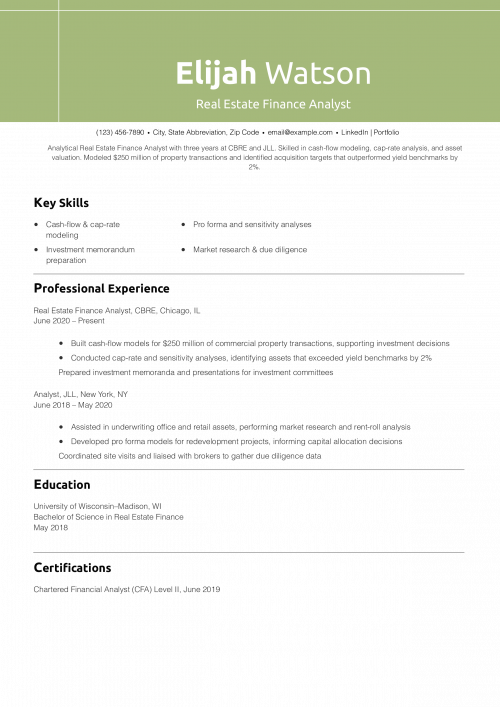

Real Estate Finance Analyst Resume Example

Why This Resume Is a Great Example

The resume ties modeling volume and yield outperformance directly to investment success, showcasing both technical skill and market insight.

Key Tips

Emphasize any performance deltas to demonstrate value. For details on featuring your competencies, see Core Competencies Resume.

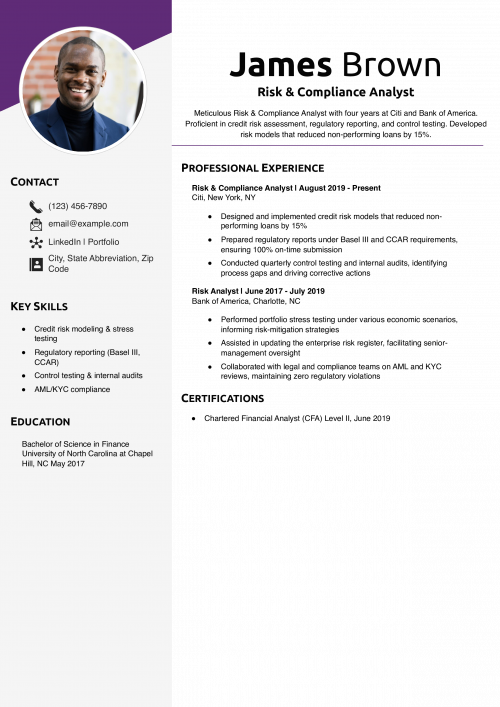

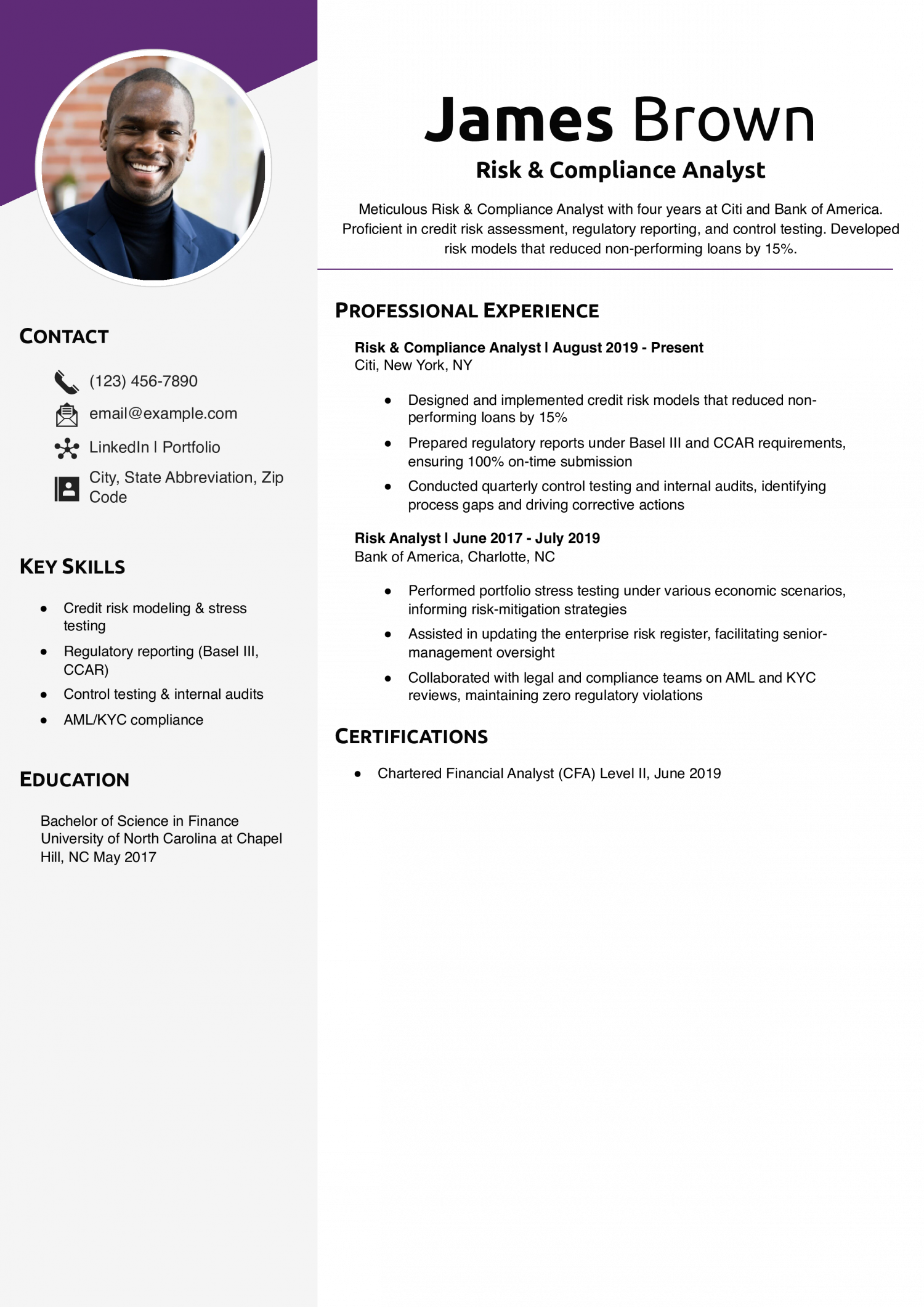

Risk & Compliance Analyst Resume Example

Why This Resume Is a Great Example

Quantifying a 15% reduction in non-performing loans and zero violations demonstrates both analytical rigor and compliance success.

Key Tips

Link risk outcomes to metrics like loan performance or audit results to strengthen impact statements. For more on compliance language, see Career Advice: Resume Job Description.

Financial Accountant Resume Example

Why This Resume Is a Great Example

Clear, measurable achievements, such as reducing close time by 30%, demonstrate process-improvement mindset and mastery of GAAP and SOX.

Key Tips

Emphasize your compliance results and automation wins. For action-word inspiration, see Resume Action Words.

Finance Text-Only Resume Examples and Templates

How To Write a Finance Resume Example

Ensure your finance resume looks professional and well-organized by using a ready-made template. Your finance resume should include these sections:

- Contact information

- Profile

- Key skills

- Professional experience

- Education and certifications

1. Share your contact information

List your current contact information in the header at the top of your resume. Include your full name, phone number, email address, location, and a link to your online professional profile. This ensures hiring managers and clients can easily reach you for more information or to schedule an interview.

Example

Your Name

(123) 456-7890

[email protected]

City, State Abbreviation Zip Code

LinkedIn | Portfolio

2. Write a dynamic profile summarizing your qualifications

A resume profile concisely summarizes the professional experiences of your most recent job titles, years of experience, and unique specializations within finance. As you create your profile, use the job description as a guide to align your resume with the role’s requirements. Highlighting what’s most relevant shows potential employers you’re an ideal candidate who can contribute to their financial goals.

Senior-Level Profile Example

A dedicated and results-driven financial professional with extensive experience in the field, possessing a Master’s in Business Administration. Proven track record in strategic financial planning and leadership during roles at top-tier companies with a demonstrated ability to improve economic positions, ensure legal compliance, and lead efficient teams. Certified as a Public Accountant (CPA) and Chartered Financial Analyst (CFA), offering a robust skill set that encompasses advanced financial analysis, implementation of financial legislation and compliance measures, and team management skills.

Entry-Level Profile Example

An enthusiastic finance professional offering extensive knowledge in financial modeling, corporate finance, and software proficiency backed by a bachelor’s degree in Business Administration (Finance) from the University of Washington. Entry-level and internship experience helped develop skills in budget management, compliance support, and accounts receivable/payable management.

3. Add a compelling section featuring your finance experience

This section of your resume should clearly outline your career trajectory within finance. Starting with your most recent job first, describe past duties and achievements, recounting times when you worked on a team, optimized operations, mitigated a risk, or increased profitability. Hiring managers like to see results, so quantify your work when you can.

Senior-Level Professional Experience Example

Senior Finance Manager, PricewaterhouseCoopers (PWC), Boston, MA | January 2016 – present

- Led the development and implementation of long-term financial strategies that improved the company’s economic position by 30% over five years

- Managed the production and analysis of complex financial reports, ensuring conformity to legal and organizational standards

- Supervised a team of 12 junior finance specialists: undertook hiring, training, and mentoring responsibilities that resulted in a more efficient and effective team

Financial Analyst Supervisor, Ernst & Young (EY), Stanford, CA | July 2010 – December 2015

- Executed strategic financial planning responsibilities; designed and implemented financial models that predicted future market trends, aiding business strategies

- Maintained compliance with financial legislation by overseeing and managing the company’s financial operations, ensuring complete accuracy in all financial procedures and reports

- Led teams and applied innovative communication strategies for external stakeholders to build robust relationships

Entry-Level Professional Experience Example

Entry-Level Finance Associate, PricewaterhouseCoopers (PWC), Seattle, WA | June 2022 – present

- Assist in the development and management of budgets, creating detailed analyses and reports to comprehend the company’s financial performance

- Participate in ensuring compliance with legal requirements and internal policies by supporting the collection of documentation for internal and external audits

- Handle accounts receivables and payables through compiling, processing, and maintaining accurate records of bills and invoices, managing bank reconciliations, overseeing timely payments, and routinely interacting with clients and suppliers over payment issues

Intern – Finance Department, Deloitte, Philadelphia, PA | May 2023 – August 2023

- Developed budget forecasts and financial planning as part of the financial team

- Assisted in the preparation of routine reporting and audit documentation to demonstrate compliance with internal policies and regulations

- Gained hands-on experience in managing accounts receivables and payables by maintaining the company’s bills and invoices records, resolving payment issues with clients and suppliers, and performing bank reconciliations

Resume writer’s tip: Quantify your experience

As a finance professional, you know that numbers can be more impactful than words alone. Quantifying your experience provides concrete evidence of your capabilities. Each time you use numbers to illustrate your past achievements, you convey a sense of measurable value. This increases credibility and helps hiring managers gauge the scale and impact of your work.

Do

- “Manage a portfolio of more than 150 loans, closing on at least 20 loans per year.”

Don’t

- “Responsible for the management and closing of a large portfolio of loans.”

Resume writer’s tip: Tailor your resume for each application

The job outlook for professionals in finance is bright, with faster-than-average growth predicted for the next 10 years. Although demand will likely continue to increase, your resume must be well-tailored to land your dream job. To resonate with hiring managers, each resume you submit should be uniquely customized for that specific position and organization.

Start by identifying the key qualifications the employer values. Then, highlight similar skills, experiences, and qualifications on your resume. Include those keywords from the job ad throughout your document to optimize it for ATS now used by many employers. Your goal is to show you meet the unique criteria of each finance job you apply for.

What if you don’t have experience?

While you may not have held an established role yet, you can leverage a wide range of assets to create an effective finance resume. If you have a robust academic background, start by featuring your degrees, honors, scholastic achievements, and related coursework prominently on your resume. Include internship and externship experiences as well.

Next, consider the transferable skills you have that easily translate across industries and roles. Things like analytical thinking, software proficiency, and customer service are all essential to a well-rounded portfolio. If you were involved in extracurricular finance clubs and associations or donated your time and finance skills as a volunteer, be sure to describe these experiences.

4. Add finance education and certifications

The education section should start with your highest degree and any other finance-related academic experience, including relevant coursework and honors. Next, list certifications that could help set you apart from other applicants. Prioritize finance and industry-specific credentials such as Certified Public Accountant (CPA) or CFA.

Education

Template:

[Degree Name]

[School Name], [City, State Abbreviation] | [Graduation Year]

Example:

Bachelor of Science (B.S.) Finance, September 2012 – June 2016

Wayne State University, Detroit, MI

Certifications

Template:

[Certification Name], [Awarding Organization], [Completion Year]

Example:

- Chartered Financial Analyst (CFA), CFA Institute, 2020

5. List key finance skills and proficiencies

Whether you’re a credit counselor or financial manager, a key skills list immediately communicates to hiring managers what you’re capable of within your field. Technical competency and interpersonal dynamics are equally important in finance. Include both skill types on your resume while customizing the list to align with the demands of the job.

Here are some possible skills you can include:

| Key Skills and Proficiencies | |

|---|---|

| Accounting principles and practices | Budgeting |

| Data analysis and interpretation | Financial modeling |

| Investment analysis | Market research |

| Negotiation | Portfolio management |

| Tax planning and compliance | Valuation techniques |

Resume writer’s tip: Use specific action verbs

To instantly improve the professional experience section of your finance resume, use action verbs instead of first-person language (e.g., “I was responsible for…”). These words help to quantify your work history and frame your daily responsibilities as accomplishments. As you describe the work you’ve done in past jobs, start each bullet point with an action verb like the ones we’ve listed below:

| Action Verbs | |

|---|---|

| Analyzed | Balanced |

| Budgeted | Calculated |

| Consolidated | Forecasted |

| Implemented | Invested |

| Modeled | Negotiated |

| Optimized | Reconciled |

| Streamlined | Underwrote |

| Validated | |

How To Pick the Best Finance Resume Template

When choosing a resume template for finance, go with one that is professional, simple, and easy to read so that your qualifications and skills are the focus. Stay away from heavily designed templates that could be distracting or difficult for ATS to read.

Frequently Asked Questions: Finance Resume Examples and Advice

There are many different roles under the umbrella of finance so it's important to zoom in on your specific skills. For instance, if you're a financial analyst, your resume should include specific skills and accomplishments to demonstrate your proficiency in that role. You can also go a step further by looking at job descriptions and finding ways to match your skills and experience to what the employer is seeking.

Creating a Finance resume example that stands out involves focusing on your unique contributions. Whether you've worked in leadership, handled large budgets, or managed complex projects, showcase your experience with measurable results. Include your proficiency in relevant tools and technologies, and make sure your resume reflects your career trajectory in a clear and concise manner.

The reverse-chronological resume format is the most widely used option, and it works well for finance professionals. Hiring managers like seeing your most recent accomplishments front and center while also looking back at your job history and related accomplishments.

include a cover letter with your resume

Crafting a cover letter to supplement your resume can allow you to describe what makes you a strong fit for a particular role.

Check Out Related Examples

Resume Templates offers HR approved resume templates to help you create a professional resume in minutes. Choose from several template options and even pre-populate a resume from your profile.