Your financial analyst resume should display how you’ve helped organizations and businesses make informed financial decisions. Hiring managers need to be confident in your ability to drive financial success and mitigate risks for their operations. We’ll provide examples and expert tips to help you create a compelling resume that demonstrates your unique skills and experiences in finance.

Key takeaways:

- Emphasize analytical strengths: Whether in retail, health care, tech, or any other sector, immediately highlight your area of expertise in the profile section. Hiring managers need to know you have the industry knowledge needed to excel in that new position.

- Quantify your results: Numbers are your forte, so put those skills to use by quantifying your own past accomplishments. Percentage improvements, cost savings, and revenue growth should be described using numbers to convey your measurable value.

- Incorporate industry-specific keywords: Applicant Tracking Systems (ATS) look for keywords and phrases as they scan resumes. Using the job description as a guide, include relevant language and finance skills that match your own within your document.

Most Popular Financial Analyst Resumes

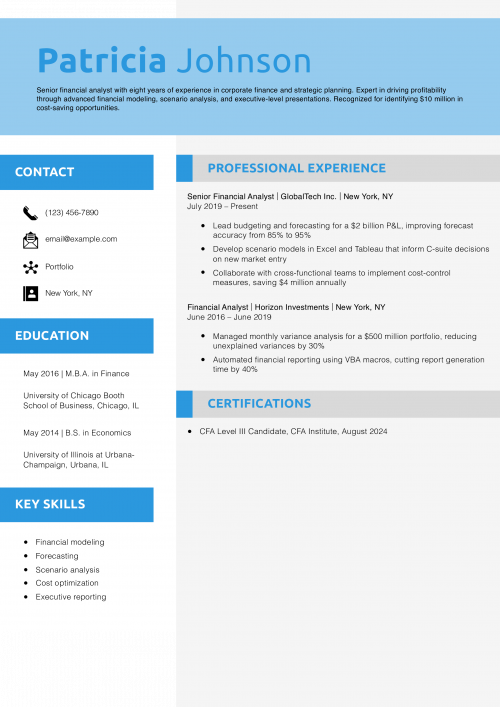

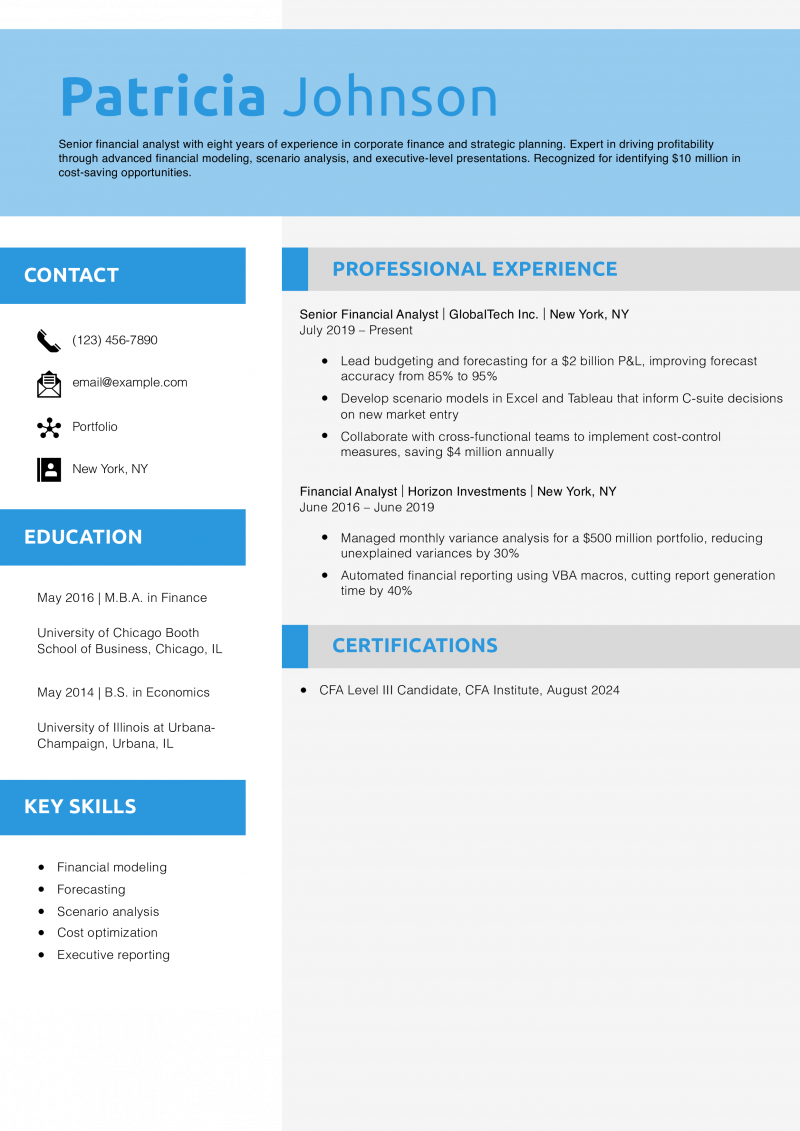

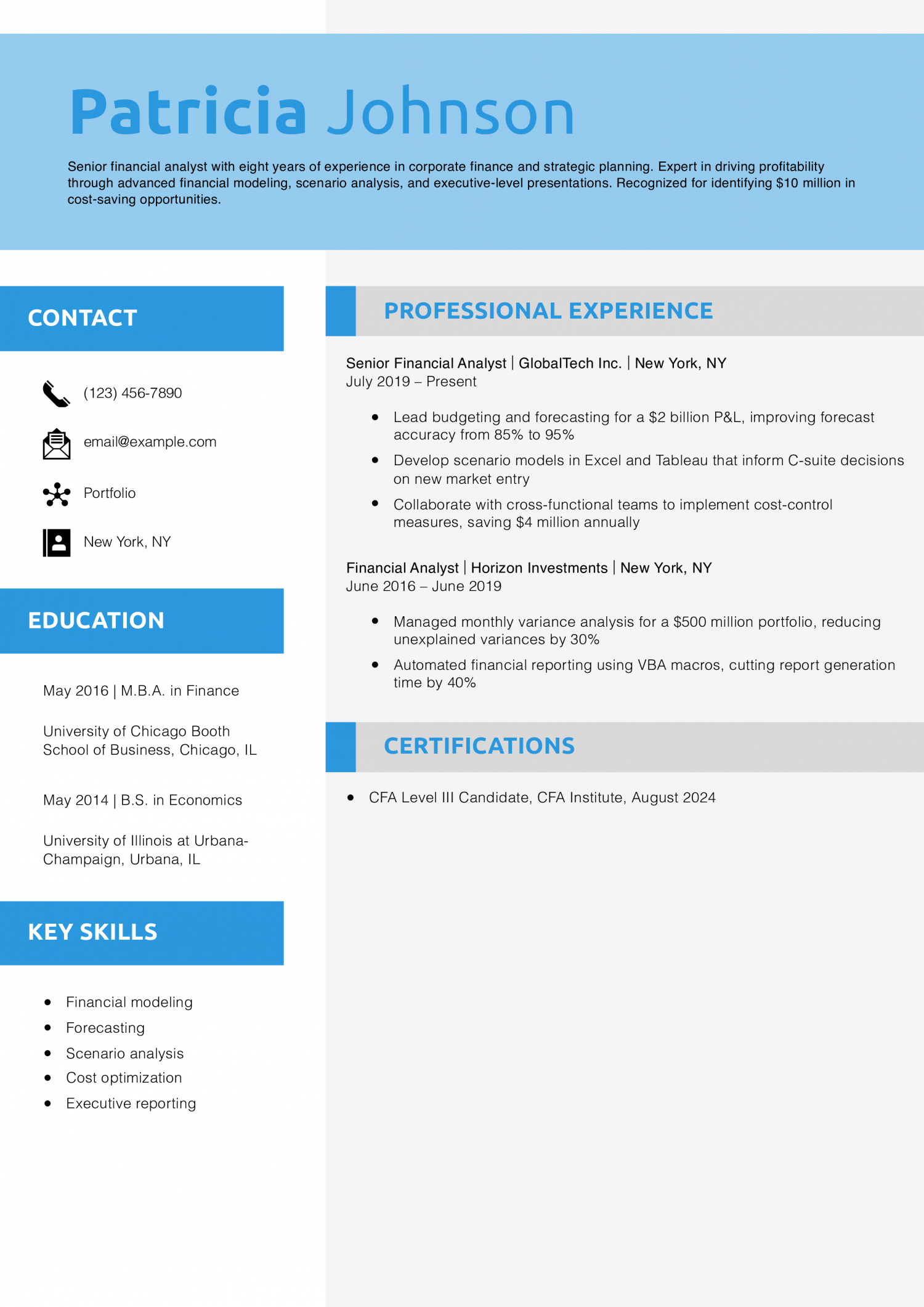

Senior Financial Analyst Resume Example

Why This Resume Is a Great Example

This resume clearly demonstrates senior-level impact, tying advanced modeling and forecasting improvements to multimillion-dollar savings. The reverse-chronological format highlights progression and leadership in high-stakes environments.

Key Tips

Quantify your leadership in forecasting and cost-saving initiatives to showcase strategic value. For guidance on structuring your resume, see Best Resume Formats.

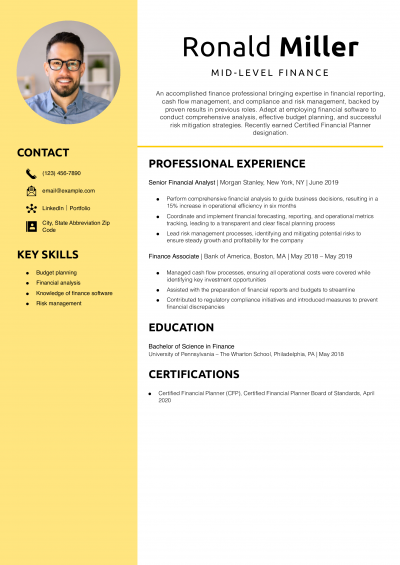

Entry-Level Financial Analyst Resume Example

Why This Resume Is a Great Example

This resume showcases measurable internship achievements, like variance savings and dashboard efficiencies, demonstrating readiness for a full-time analyst role. The concise profile establishes core skills.

Key Tips

Emphasize measurable internship contributions to stand out as an early-career professional. For guidance on writing strong objectives, see Resume Objective Examples.

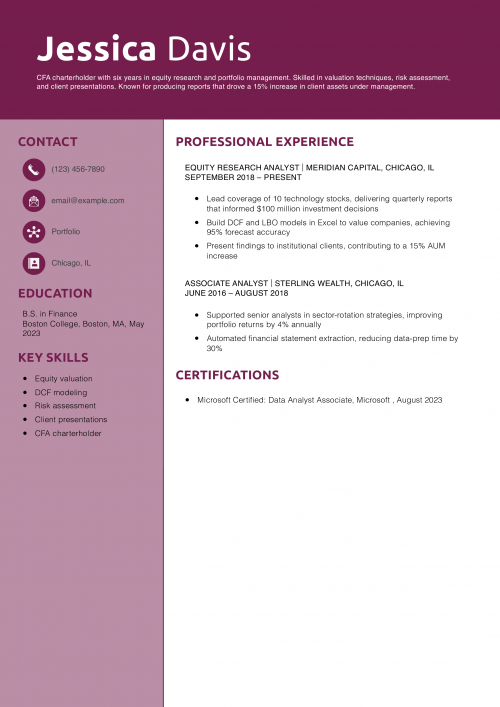

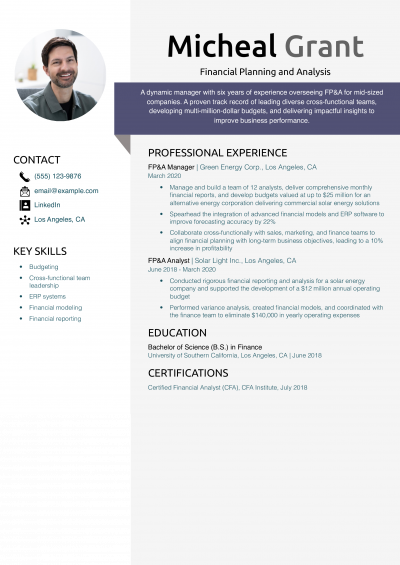

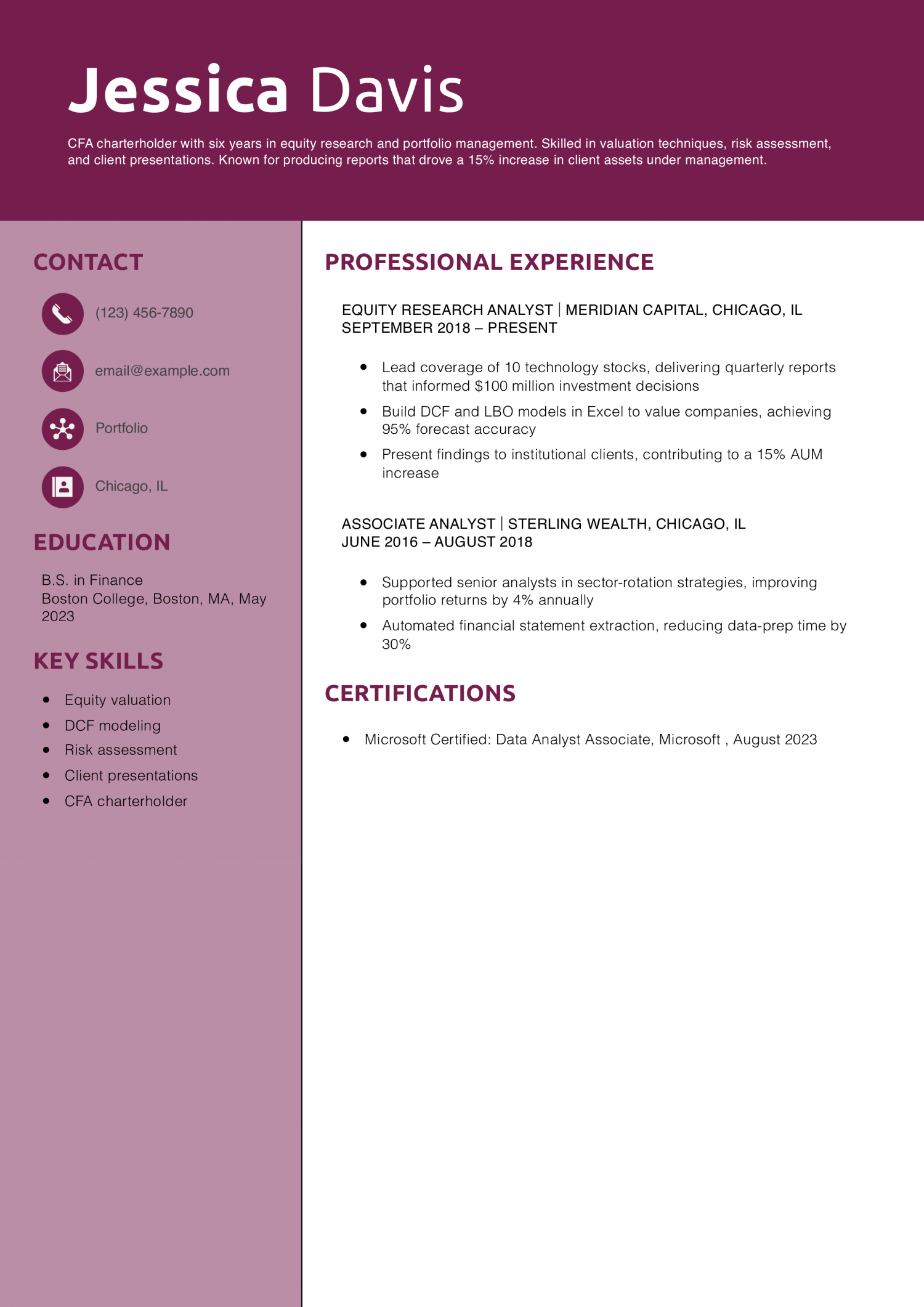

Chartered Financial Analyst Resume Example

Why This Resume Is a Great Example

This resume ties CFA credentials and equity-research outputs to client AUM growth, highlighting both technical mastery and business impact. The role descriptions clearly quantify model accuracy and return improvements.

Key Tips

Leverage your CFA credential and valuation achievements to demonstrate expertise. For tips on highlighting transferable skills, see Transferable Skills Resume.

Corporate Financial Analyst Resume Example

Why This Resume Is a Great Example

This resume highlights process improvements — like budgeting accuracy and reporting efficiency — with quantifiable metrics, demonstrating both technical and collaborative strengths. The profile clearly states domain expertise.

Key Tips

Showcase cross-functional FP&A achievements and process redesign successes. For advice on listing skills, see How to List Skills on a Resume.

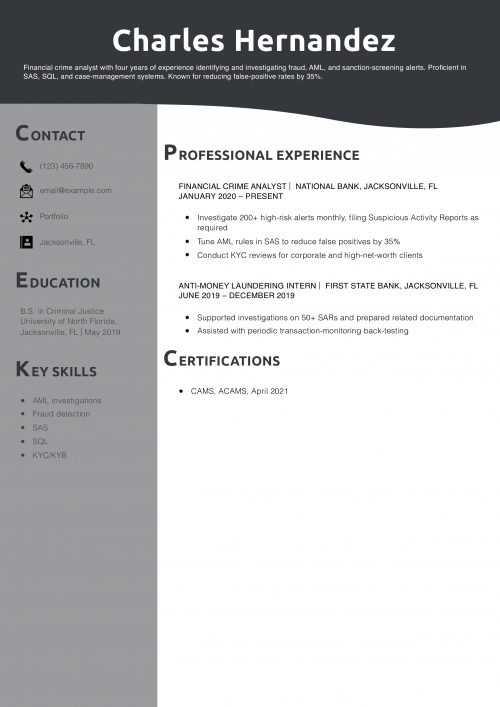

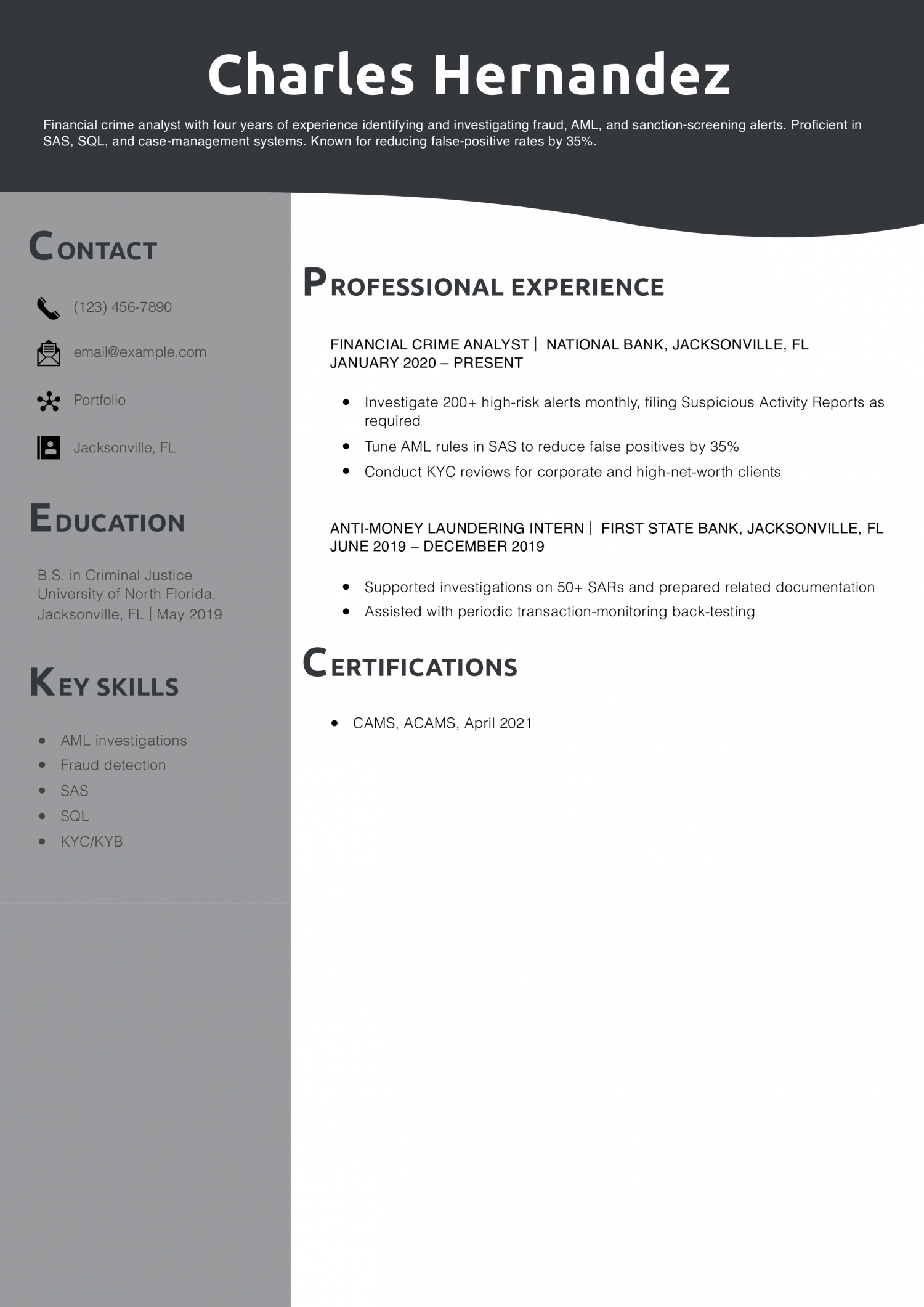

Financial Crime Analyst Resume Example

Why This Resume Is a Great Example

This resume quantifies both alert volume and false-positive reduction, showcasing technical tuning and investigative impact. The profile emphasizes compliance expertise.

Key Tips

Emphasize your false-positive reduction metrics and AML certifications to demonstrate specialized value. For resume planning, see How Far Should a Resume Go.

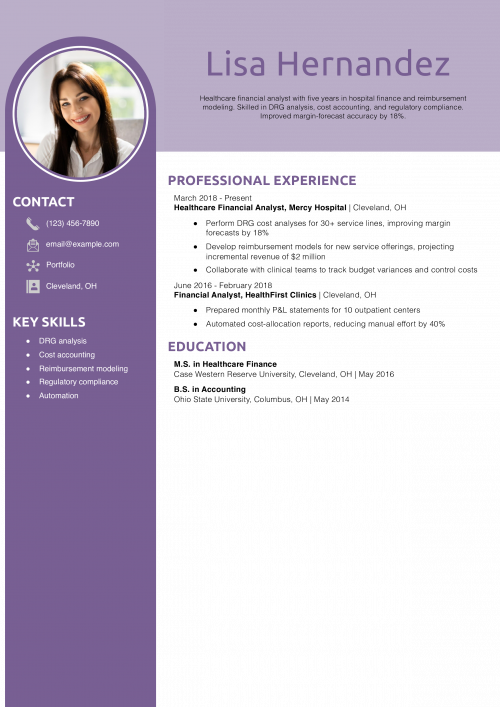

Healthcare Financial Analyst Resume Example

Why This Resume Is a Great Example

This resume links DRG-analysis improvements and reimbursement-modeling outcomes to tangible forecasting-accuracy gains, demonstrating domain expertise and process efficiency.

Key Tips

Highlight your DRG and cost-accounting successes to showcase healthcare finance acumen. For education-listing tips, see How to List Education on a Resume.

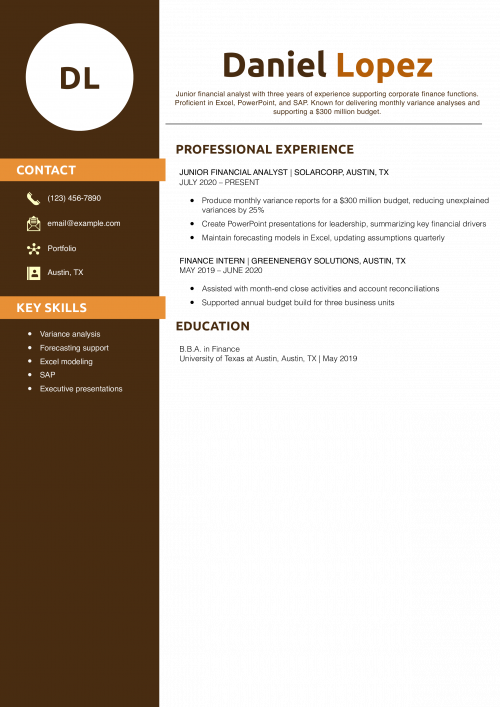

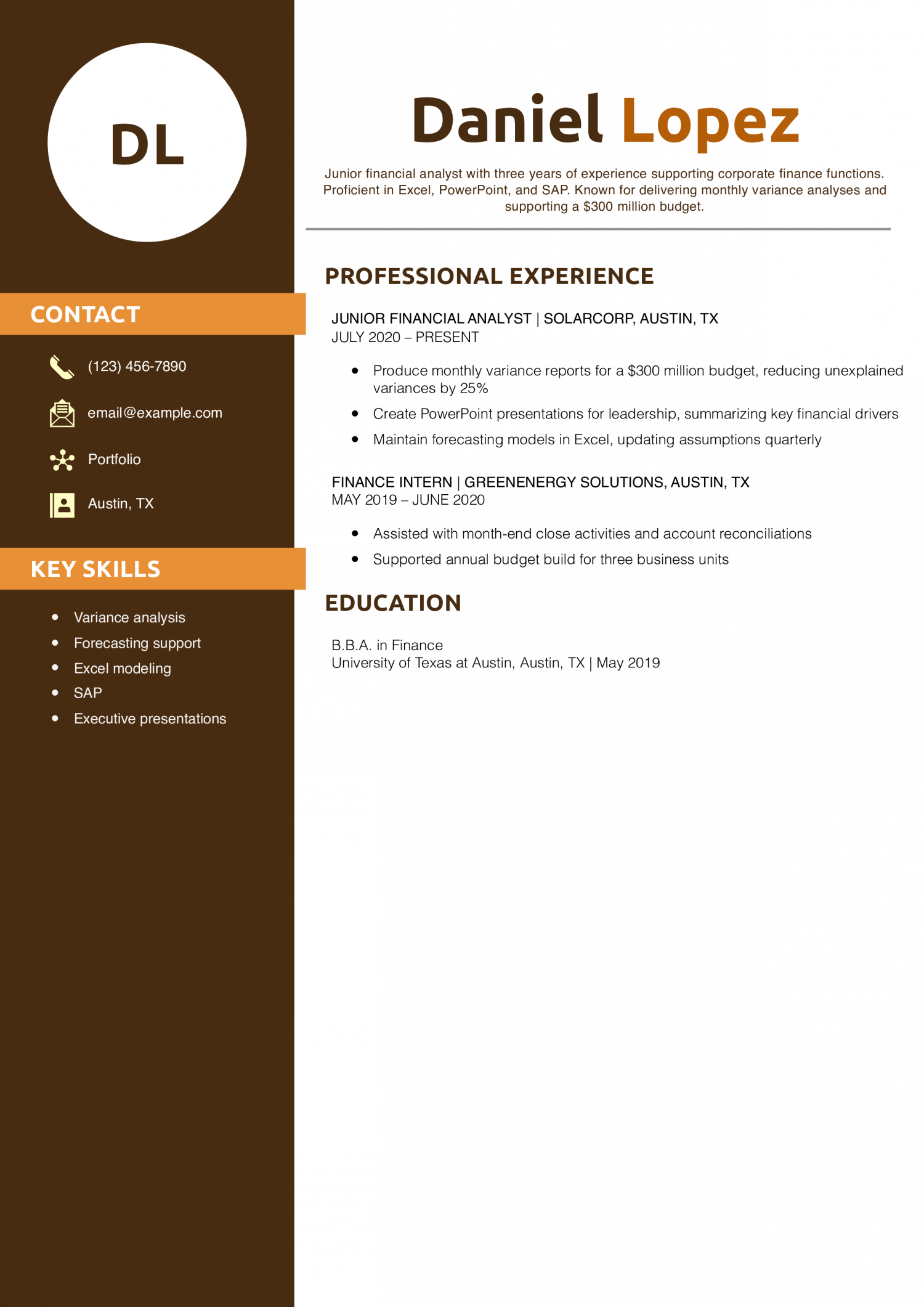

Junior Financial Analyst Resume Example

Why This Resume Is a Great Example

This resume highlights variance-analysis improvements and executive reporting contributions, demonstrating readiness for greater FP&A responsibilities. The profile clearly outlines core tools and tasks.

Key Tips

Quantify your impact on variance reduction and reporting efficiency. For tips on listing publications or projects, see How to List Publications on a Resume.

Real Estate Financial Analyst Resume Example

Why This Resume Is a Great Example

This resume ties Argus modeling and cap-rate analyses to high-value acquisitions and NOI improvements, illustrating both technical and strategic impact. The format highlights real estate specialization.

Key Tips

Showcase your Argus and DCF achievements to demonstrate real estate finance expertise. For resume length guidance, see How Long Should a Resume Be.

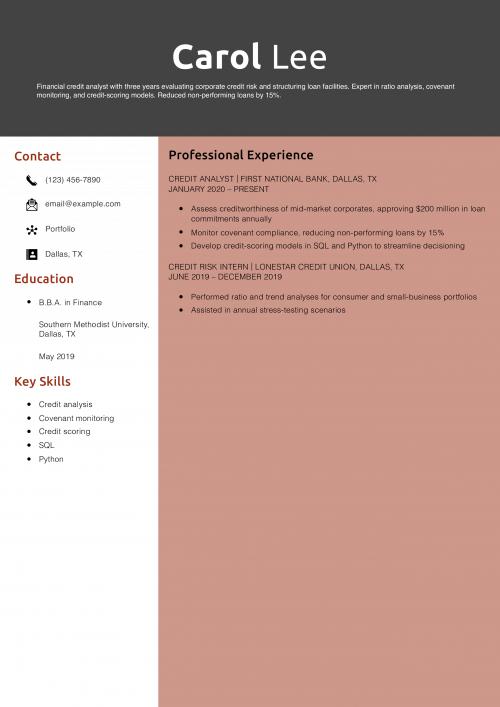

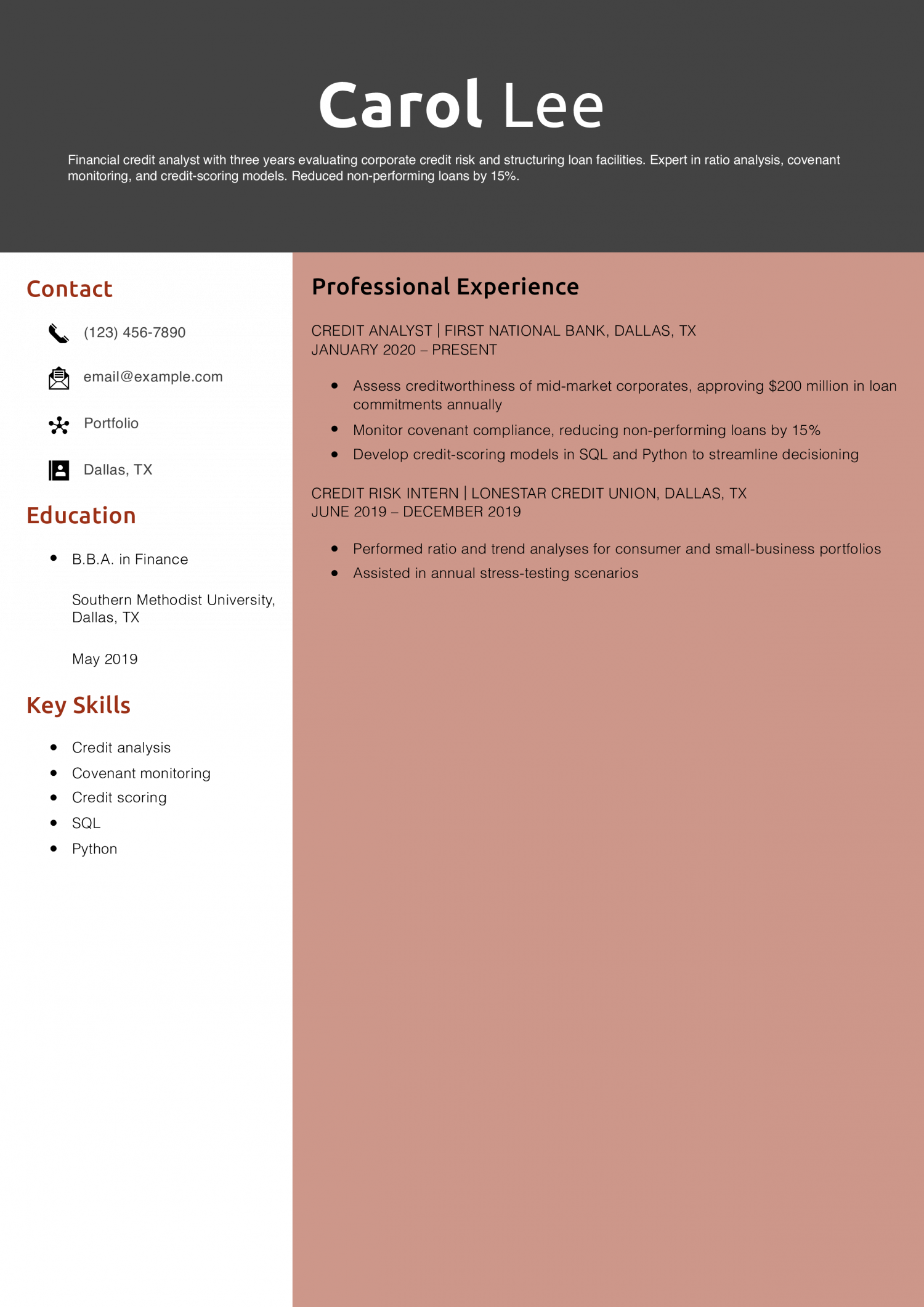

Financial Credit Analyst Resume Example

Why This Resume Is a Great Example

This resume highlights both credit-risk reductions and model-automation successes, showcasing technical and risk-management capabilities. The bullet points quantify impact on loan performance.

Key Tips

Emphasize your risk-reduction metrics and modeling skills to demonstrate credit expertise. For insights on tailoring to job descriptions, see How to Tailor Resume to Job Description.

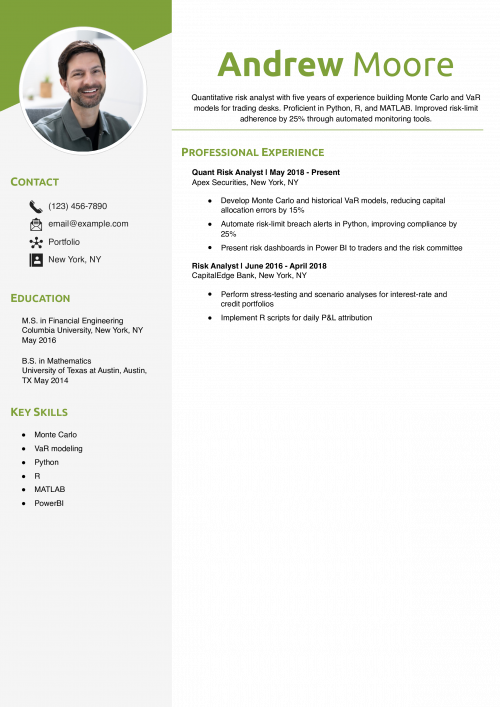

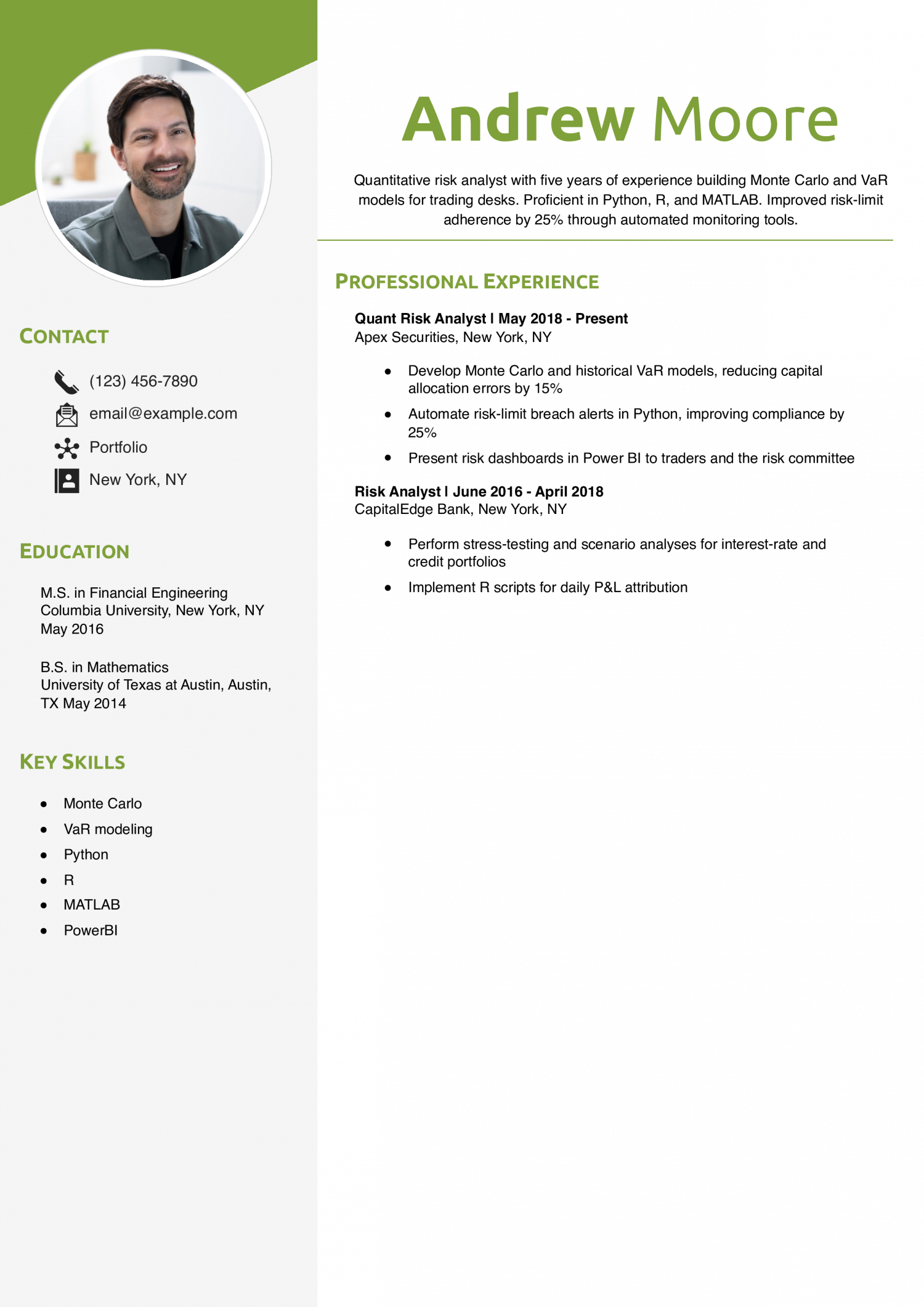

Quantitative Risk Analyst Resume Example

Why This Resume Is a Great Example

This resume ties quantitative modeling improvements to compliance and capital-efficiency gains, demonstrating both technical rigor and business impact. The profile sets expectations for advanced analytics.

Key Tips

Highlight your model-automation and risk-reduction achievements to showcase quantitative strength. For tips on structuring math-focused resumes, see How a Resume Should Look for a College Student.

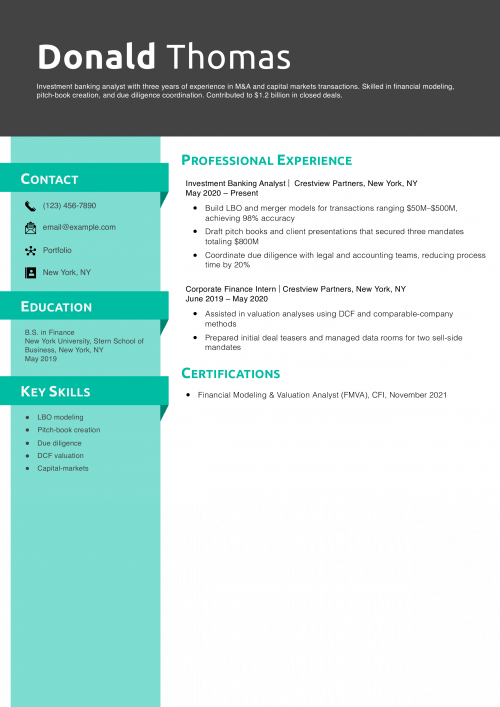

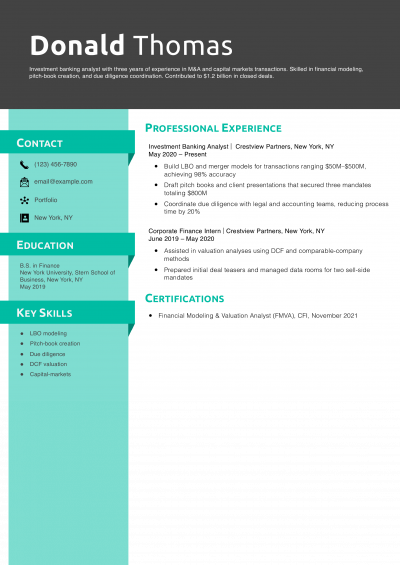

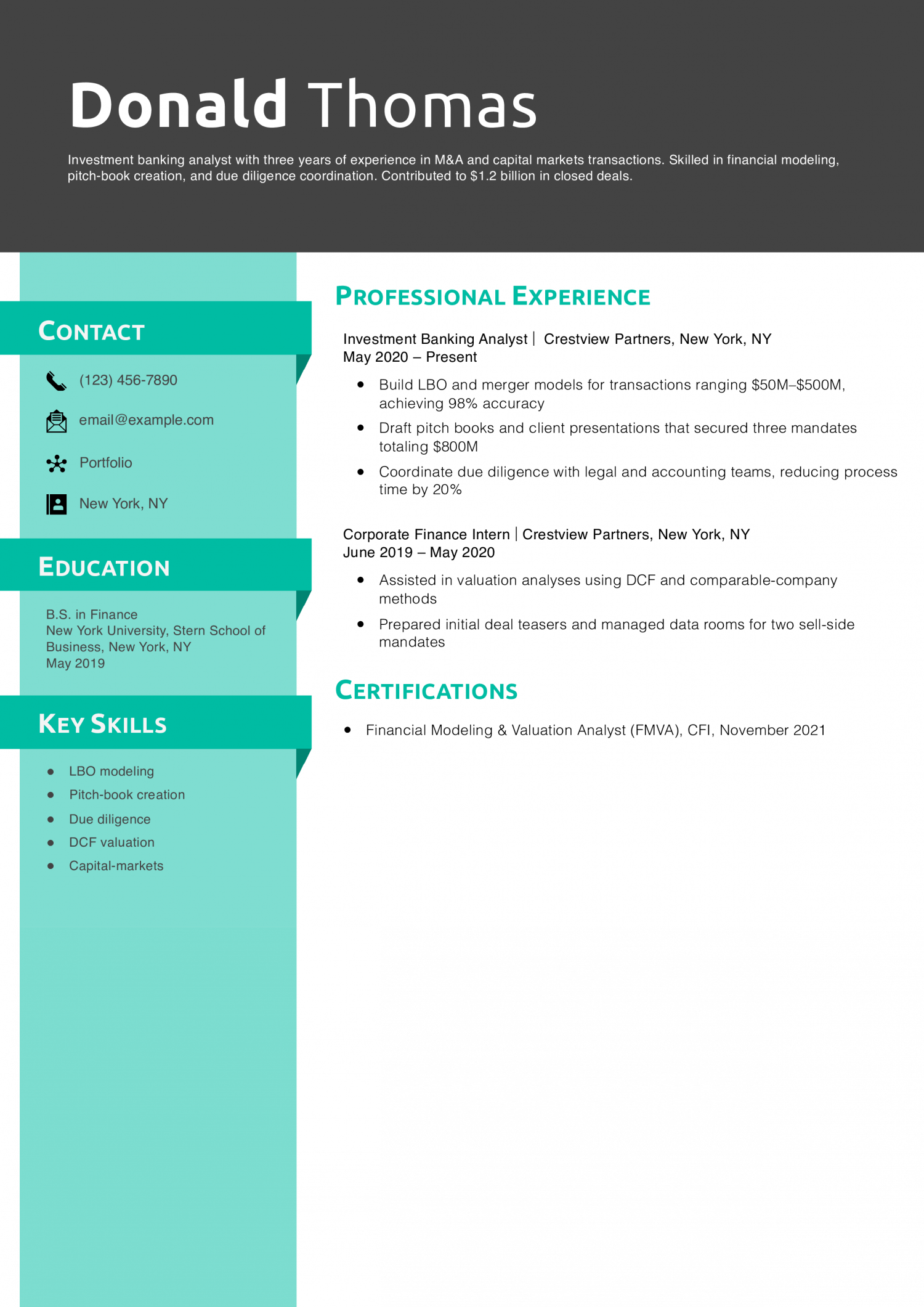

Investment Banking Analyst Resume Example

Why This Resume Is a Great Example

This resume clearly ties modeling accuracy and deal-success metrics to specific transaction sizes, demonstrating both technical prowess and real-world impact. The concise profile sets expectations for high-stakes finance roles.

Key Tips

Highlight your transaction-value metrics and modeling accuracy to stand out in investment banking. For guidance on writing your first full-time resume, see How to Write Your First Job Resume.

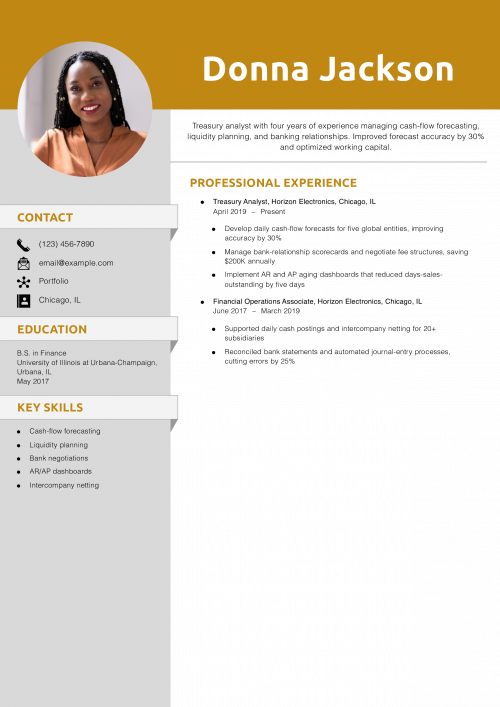

Treasury Analyst Resume Example

Why This Resume Is a Great Example

This resume ties process improvements and forecast-accuracy gains to quantifiable savings and liquidity outcomes, showcasing both technical and negotiation skills. The clear profile frames the treasury focus.

Key Tips

To showcase your treasury expertise, emphasize your forecasting accuracy and cost-saving achievements. For sample job titles, see Job Title Examples for Your Resume.

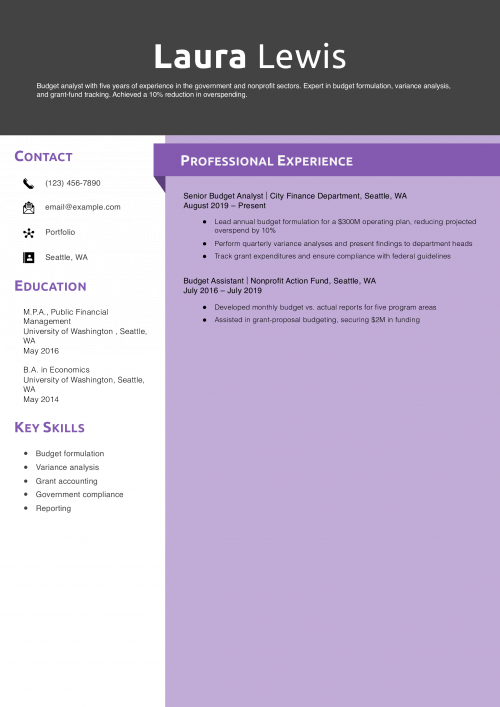

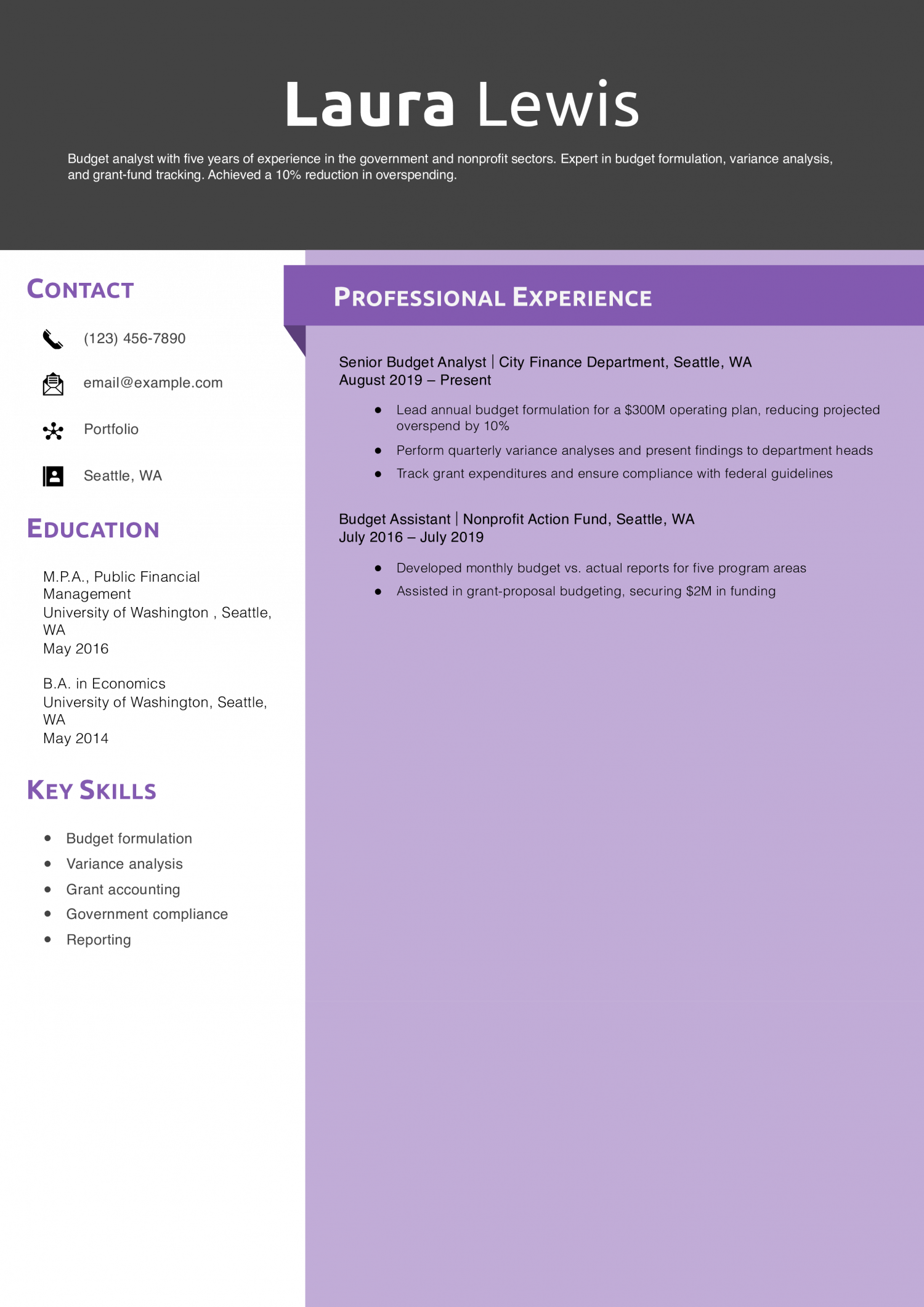

Budget Analyst Resume Example

Why This Resume Is a Great Example

This resume quantifies overspending reductions and grant successes, demonstrating both analytical rigor and compliance expertise. The profile clarifies the public-sector focus.

Key Tips

Highlight your budget-reduction metrics and grant-funding wins to illustrate impact. For tips on structuring public-sector resumes, see How a Resume Should Look for a College Student.

Revenue Analyst Resume Example

Why This Resume Is a Great Example

This resume connects ASC 606 compliance expertise to revenue increases and automation gains, demonstrating both technical knowledge and process efficiency.

Key Tips

Emphasize your compliance and automation improvements to showcase revenue expertise. For advice on listing degrees, see How to List Degrees on a Resume.

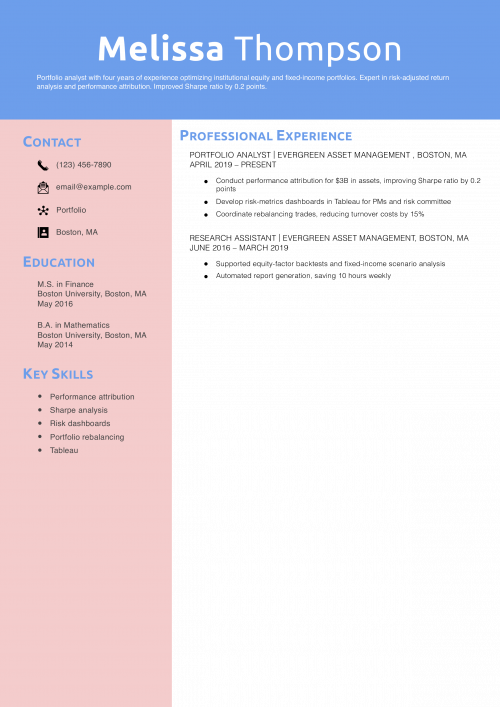

Portfolio Analyst Resume Example

Why This Resume Is a Great Example

This resume quantifies risk-adjusted performance gains and cost reductions, showcasing both analytical impact and process improvements. The role descriptions clearly align with portfolio goals.

Key Tips

Highlight your attribution and risk-metric achievements to illustrate portfolio expertise. For presentation tips, see Career Advice: Resume Job Description.

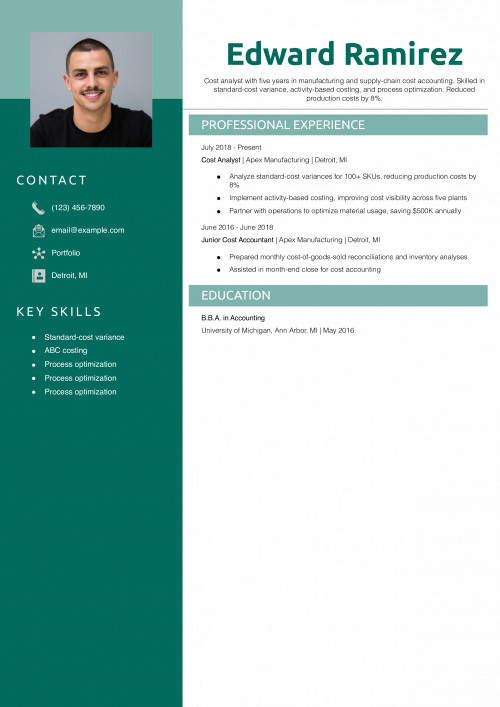

Cost Analyst Resume Example

Why This Resume Is a Great Example

This resume ties cost-accounting improvements to production savings and process visibility gains, demonstrating both technical and cross-functional impact.

Key Tips

Emphasize your cost-reduction metrics and ABC implementation to showcase manufacturing finance expertise. For skills-listing guidance, see How to List Skills on a Resume.

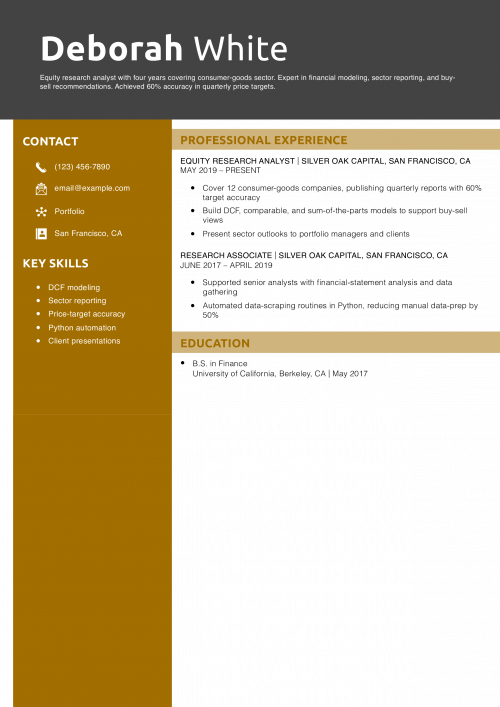

Equity Research Analyst Resume Example

Why This Resume Is a Great Example

This resume links model-accuracy metrics and automation gains to better sector coverage, showcasing both analytical and technical skills in equity research.

Key Tips

Highlight your model-accuracy records and automation successes to demonstrate research strength. For insights on presenting work experience, see Work Experience on a Resume.

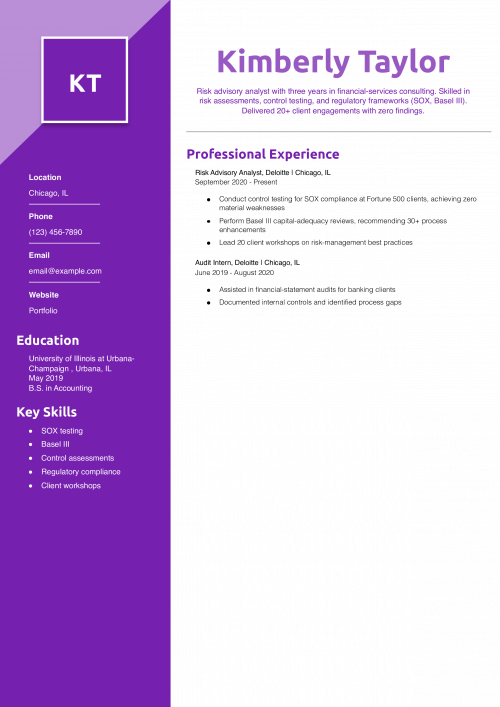

Risk Advisory Analyst Resume Example

Why This Resume Is a Great Example

This resume ties regulatory engagement results and control-testing successes to zero-finding outcomes, demonstrating consulting excellence and compliance expertise.

Key Tips

Emphasize your audit findings and regulatory deliverables to showcase advisory impact. For personal statement examples, see Resume Personal Statement Examples.

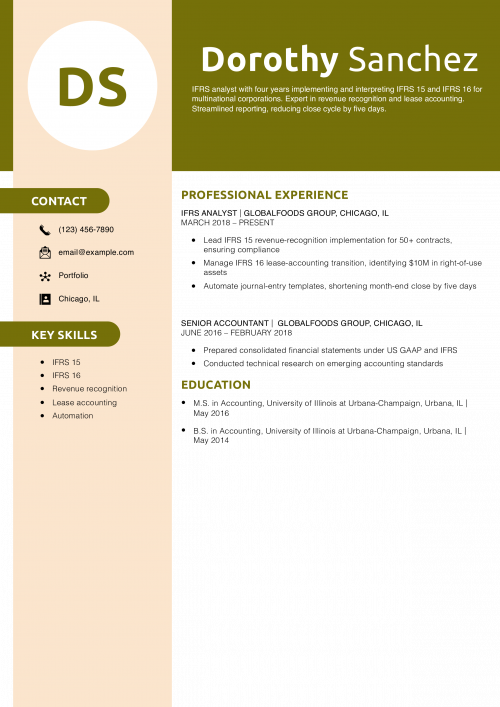

IFRS Analyst Resume Example

Why This Resume Is a Great Example

This resume connects IFRS implementations to reporting-cycle improvements and balance-sheet metrics, demonstrating both technical depth and efficiency gains.

Key Tips

Highlight your standards-implementation achievements and close-cycle reductions to demonstrate IFRS expertise. For format advice, see Best-Looking Resumes.

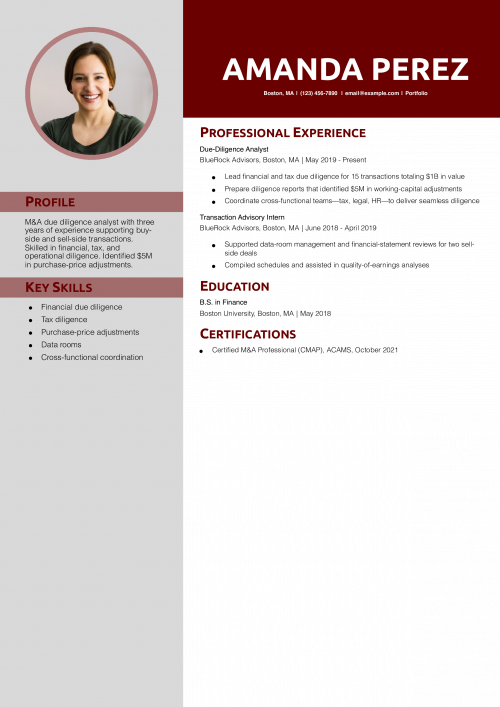

M&A Due-Diligence Analyst Resume Example

Why This Resume Is a Great Example

This resume ties due-diligence contributions to material purchase-price adjustments and transaction values, showcasing analytical impact on deal economics.

Key Tips

Quantify your diligence findings and coordination achievements to illustrate M&A expertise. For layout tips, see How to Build a Professional Resume.

Financial Analyst Text-Only Resume Examples and Templates

How To Write a Financial Analyst Resume Example

When getting ready to create your financial analyst resume, ensure your resume template includes all the key elements. This helps potential employers get a good understanding of your qualifications and the value you’d bring to the organization. These sections include:

- Contact information

- Profile

- Key skills

- Professional experience

- Education and certifications

1. Share your contact information

Hiring managers need to know how to reach you, so start the resume with your full name, email address (a professional one), and phone number. You can also include your city/state of residence and a link to your LinkedIn profile.

Example

Your Name

(123) 456-7890

[email protected]

City, State Abbreviation Zip Code

LinkedIn

2. Write a brief summary of your financial analyst qualifications

To grab the reader’s attention, you’ll need a succinct, well-written profile section. Think of it as a quick summary of your entire resume, highlighting why you’re the go-to analyst for turning complex financial data into actionable insights.

Mention your years of experience, areas of financial expertise, and any notable achievements or specializations. If you are concerned about age discrimination, rather than showing your years of experience, simply say “experienced.”

For example, maybe you have a track record of identifying risks and opportunities that have led to successful deals — mention that here. Or, if you’ve developed a proprietary valuation model or consistently outperformed market benchmarks in your investment recommendations, include that key information in your profile. The goal is to impress the hiring manager and convey your unique value proposition.

Senior-Level Profile Example

Strategic financial analyst with nearly 10 years in the pet retail and health care space. Leader who drives cross-functional teams to optimize supply chain efficiency. Drives e-commerce growth through predictive modeling of consumer behavior and data-driven product line expansion.

Entry-Level Profile Example

Results-driven financial analyst with a two-year background in investment accounting and bond portfolio management. Recognized for developing innovation risk assessment models and Excel macros to improve valuation accuracy and identify millions in potential savings.

3. Outline your financial analyst experience in a compelling list

The bulk of your resume will consist of your work history. List past jobs starting with your title, employer name and location, and employment dates. Then, provide a few bullets to overview your key accomplishments at those jobs. Consider the industry expectations and specific experiences hiring managers will be looking for.

Analysts are expected to work cross-functionally and influence key decision-making at all levels. Beyond crunching numbers, include examples of how you communicate complex financial concepts to non-financial stakeholders. Clear communication through financial reporting and cross-functional collaboration are just as important.

Senior-Level Professional Experience Example

Senior Financial Analyst, Chewy, Minneapolis, MN

April 2019 – present

- Oversee financial planning and analysis for Chewy’s $500 million Health Care division

- Lead a cross-functional team to implement cost-saving initiatives, resulting in $5 million in annual savings across supply chain, marketing, and customer service operations

- Developed a comprehensive financial model for the successful launch of three new product lines in telemedicine and prescription services

- Exceeded revenue projections by at least 25% in the first quarter of each product launch, leveraging advanced Excel and R for predictive modeling

- Redesigned the annual budgeting processing and reduced cycle time by seven to 10 days

Entry-Level Professional Experience Example

Financial Analyst Intern, Florida Capital Bank, Jacksonville, FL

May 2022 – August 2022

- Analyzed revenue and cost performance for five division units using Tableau

- Supported annual budgeting process for a $50 million department and contributed to a 5% reduction in overhead costs

- Conducted variance analysis on 25 budget line items through Microsoft PowerBI, identifying $75,000 in unexpected expenses

- Delivered monthly performance reports created in Excel for management review within 48 hours of month-end close

Resume writer’s tip: Quantify your experience

Anytime you can add quantitative data to your resume, you’re demonstrating an ability to tell a story with numbers. Don’t simply describe the duties you performed but bring value to the impact your contributions had on the organization. Think about how you can incorporate percentages and numerical details into the line items of your professional experience section.

Do

- “Identified opportunities to reduce expenses by 22% ($250,000) through an audit of operating costs and vendor relationships using SAP Concur”

Don’t

- “Reduced expenses after successful audit”

Resume writer’s tip: Tailor your resume for each application

Show that you’ve done your homework by tailoring your resume for every application submitted. Just like you wouldn’t use the same financial model for every scenario, the same principle applies to your resume. Research the company you’re applying to so you can better understand their market, products or services and the specific job requirements.

Adjust your profile, professional experience section, and skills list to highlight your different qualifications in light of the employer’s needs. Read the job posting carefully to see what they are. For example, if you’re applying to a firm specializing in mergers and acquisitions, emphasize your experience in due diligence, valuation modeling, and deal analysis. Discuss specific transactions you’ve worked on and their outcomes.

What if you don’t have experience?

Landing your first or second financial analyst job requires getting a recruiter or hiring manager to take a chance on you, so make your resume as strong as possible. Even if you don’t have a ton of related work history, you can include other experiences in your background that allowed you to develop the skill sets needed for the job.

For instance, if you were the treasurer for a college club or volunteer organization or completed an internship in the field, those are worth including. You can also add other types of work you did, focusing on the value you brought to your employers.

4. Add financial analyst education and certifications

Employers want to make sure you’ve acquired the knowledge needed to succeed as a financial analyst. Most employers will require entry-level financial analysts to have at least a bachelor’s degree, so list your highest level of education first.

Additionally, include any relevant certifications that you’ve earned, such as Certified Financial Analyst (CFA) or Financial Risk Manager (FRM). Industry-specific and software proficiency credentials can help you stand out from other candidates too.

Education

Template:

[Degree Name]

[School Name], [City, State Abbreviation] | [Graduation Year]

Example:

Bachelor of Science (B.S.) Finance

University of Michigan, Ann Arbor, MI | June 2017

Certifications

Template:

[Certification Name], [Awarding Organization], [Completion Year]

Examples:

Certified Financial Analyst (CFA), CFA Institute, 2018

5. Make a list of your finance-related skills and proficiencies

Hiring managers are looking for specific skills in their search for a financial analyst. Listing yours in a simple bulleted list can help them immediately see if you meet the job requirements they need to fill. It can also optimize your resume for ATS that may be scanning for keywords. The lists of hard and soft skills below are common qualifications you may come across during your job search.

| Hard Skills | |

|---|---|

| Advanced Excel functions (pivot tables, macros) | Bloomberg Terminal |

| Data visualization (Power BI, Tableau) | Financial modeling |

| Merger and acquisition (M&A) modeling | Monte Carlo simulation |

| Regression analysis | Risk analysis and management |

| Soft Skills | |

|---|---|

| Adaptability to market changes | Client relationship management |

| Collaborative financial modeling | Ethical financial decision-making |

| Financial report writing | Financial storytelling |

| Investment strategy | Stakeholder communication |

Resume writer’s tip: Use common action verbs

Choosing the right action verbs can make your career accomplishments come alive on the page. They help with readability and create a clear picture of your past experiences and skills. Instead of passive phrases that merely describe your duties, action verbs convey a proactive approach. Some common verbs that can enhance your financial analyst resume include:

| Action Verbs | |

|---|---|

| Analyzed | Assessed |

| Audited | Benchmarked |

| Compiled | Developed |

| Forecasted | Interpreted |

| Modeled | Optimized |

| Projected | Quantified |

| Reconciled | Researched |

How To Pick the Best Financial Analyst Resume Template

The most reliable resume template for financial analysts is clean and organized rather than flashy or loaded with creative elements. Look for professional templates with clear sections and plenty of room to quantify your achievements. The right template will help hiring managers quickly grasp your value proposition without sifting through clutter.

Frequently Asked Questions: Financial Analyst Resume Examples and Advice

New investment opportunities and business expansion continue to drive the need for financial analysts. Between 2022 and 2032, job growth in the field will increase faster than average, creating a healthy demand. To stand out from other analysts racing to fill these new roles, you'll need to align your resume with the job description.

Read the job posting. Look for keywords, skills, and phrases that match your own qualifications and include similar language in your resume. This shouldn't be a copy-and-paste situation but a careful incorporation to demonstrate that you're the right financial analyst for the job.

Focusing on your professional experience is the best move for a financial analyst resume, making the chronological format a great choice. From entry-level to more senior positions, hiring managers will get the full picture of your finance career. This is the standard within the industry, and most hiring managers expect to see this style of resume. It highlights your stability, progression, and most recent achievements for a comprehensive overview of your qualifications.

To optimize your Financial Analyst CV for ATS, make sure to incorporate the right keywords from the job description, especially in sections like skills, experience, and certifications. Stick to a clean, straightforward layout that avoids complicated formatting or images, as these can confuse the ATS. This will help your CV get past the automated systems and into the hands of hiring managers.

Include a cover letter with your resume

A well-written cover letter provides context to the data points of your resume. Use this space to demonstrate your financial acumen, passion for numbers, and enthusiasm for the opportunity. Give hiring managers a glimpse into why you would be the best financial analyst for the job. This is a strategic move that increases your likelihood of standing out and landing an interview.

Check Out Related Examples

Resume Templates offers HR approved resume templates to help you create a professional resume in minutes. Choose from several template options and even pre-populate a resume from your profile.